Upcoming CAD Core Retail Sales: Key Insights and Market Implications

As the financial markets prepare for the release of Canada's core retail sales data, it is crucial to understand the significance of this economic indicator and its potential impact on the Canadian dollar (CAD) and broader economic trends.

Definition and Importance

Core retail sales in Canadian dollars measure the monthly change in the total value of retail sales, excluding auto sales. This exclusion is critical because car sales can be highly volatile and may distort the overall trend in retail spending. By focusing on core retail sales, analysts and policymakers gain a clearer picture of consumer spending trends and the general health of the Canadian economy.

Economic Indicators and Consumer Spending

Core retail sales are a vital component of consumer spending, which is a key driver of economic growth. An increase in core retail sales indicates higher consumer confidence, increased disposable income, and a strong economy. Conversely, a decline in these sales can signal economic weakness and reduced consumer spending. The data provides insights into the strength of domestic demand, consumer sentiment, and potential inflationary pressures.

Recent Trends and Expectations

In recent months, Canadian retail sales have shown mixed signals. In April, core retail sales rose 1.4% driven by increases in sales at petrol stations, food and beverage retailers, and other sectors. However, this was followed by a decline of 1.4% in May, reflecting lower receipts across all core retail subsectors.

For the upcoming release, market expectations are cautiously optimistic. After a decline in June, retail sales are projected to have bounced back in July, with a forecasted increase of 0.6% month-over-month. This recovery would align with the broader economic narrative of managing inflation and avoiding a recession.

Impact on Monetary Policy

The Bank of Canada closely monitors core retail sales data to make informed decisions on monetary policy. Strong retail sales figures suggest robust consumer spending and economic activity, which may lead the Bank of Canada to maintain or adjust interest rates accordingly. Conversely, weak sales data could prompt the central bank to cut interest rates to stimulate consumer and investment spending. Given the current economic context, where inflation is under control but economic growth is sluggish, the Bank of Canada has already cut rates multiple times to support the economy.

Market Reaction and CAD

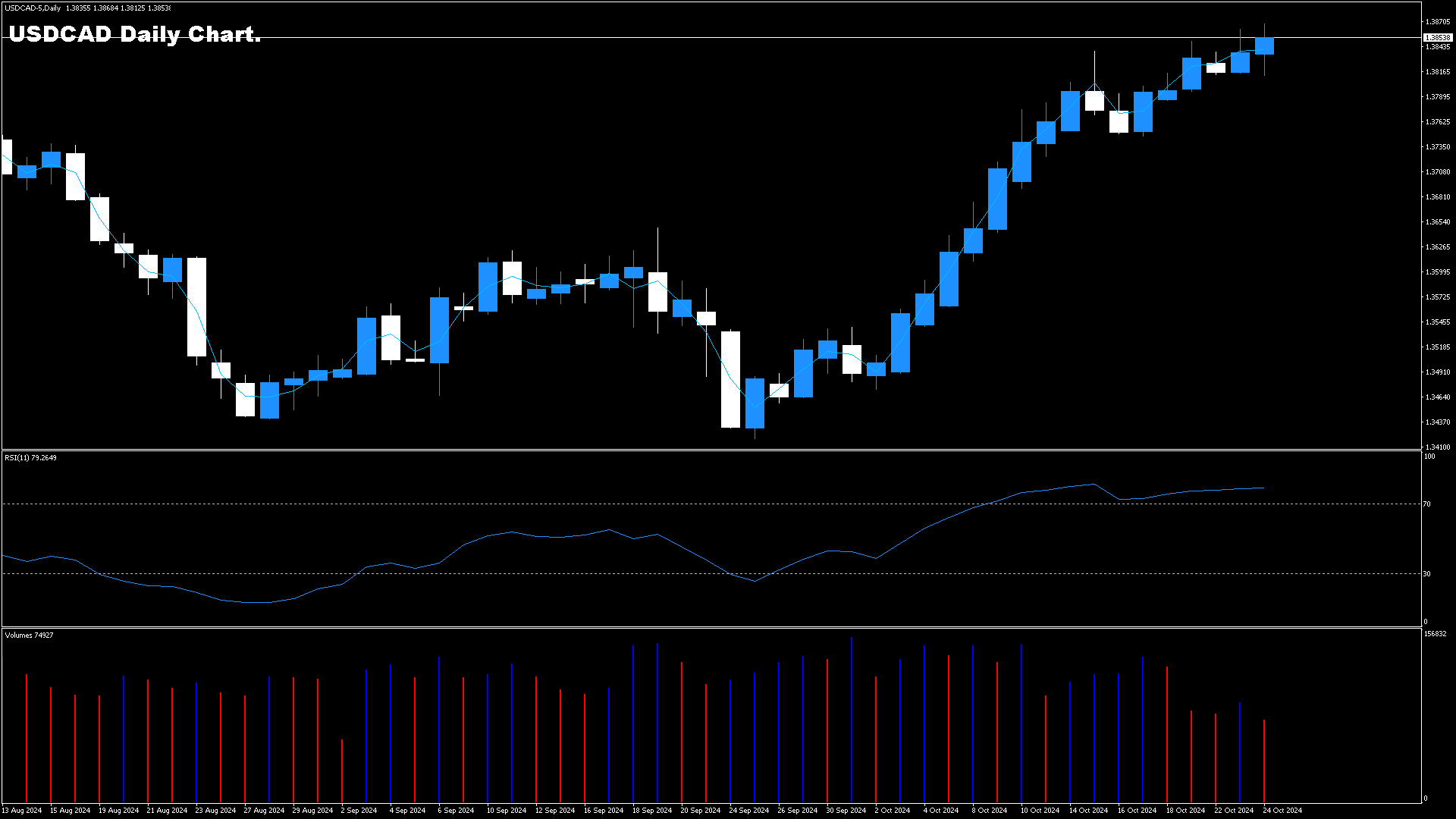

The release of core retail sales data can significantly impact the Canadian dollar. Positive surprises, such as higher-than-expected retail sales growth, could boost optimism and strengthen the CAD. Conversely, weaker-than-expected figures may have a negative impact on the currency. Currently, the USD/CAD pair is closely watched, with key resistance and support levels identified at 1.3626 and 1.3511, respectively.

Technical Analysis

From a technical perspective, the USD/CAD pair is under scrutiny as it approaches key resistance levels. A strong retail sales report could push the pair below the support levels, potentially weakening the USD against the CAD. Conversely, a disappointing report could see the pair break through resistance, strengthening the USD relative to the CAD.

Conclusion

The upcoming core retail sales data release is a critical event for market participants, policymakers, and anyone interested in the Canadian economy. The data will provide valuable insights into consumer spending trends, economic strength, and potential inflationary pressures. Given the current economic landscape, where central banks are navigating between controlling inflation and supporting economic growth, this data point will be closely watched and could have significant implications for the Canadian dollar and broader market trends.

As the market awaits the release, it is essential to stay informed about the latest economic indicators and be prepared for potential market movements. A strong core retail sales report could signal resilience in the Canadian economy, while a weak report might indicate the need for further monetary policy adjustments. Either way, the data will be a key factor in shaping market sentiment and informing trading decisions in the days to come.