Upcoming AUD Cash Rate Decision: What to Expect and Its Implications

As of November 5, 2024, the financial community is eagerly awaiting the Reserve Bank of Australia (RBA)’s decision on the Official Cash Rate (OCR), a pivotal event that can significantly influence the Australian economy and the value of the Australian Dollar (AUD).

RBA's Expected Decision

Market consensus and recent economic indicators suggest that the RBA is likely to maintain the OCR at 4.35%, marking the eighth consecutive month without a change.

This decision is largely driven by the current economic landscape, where underlying inflation, although moderating, remains above the RBA's target range of 2-3%. The annual Trimmed Mean Consumer Price Index (CPI) has slowed to 3.5% from 4.0% in the third quarter, but service-sector inflation continues to be elevated due to strong domestic cost pressures and excess demand in the economy.

Economic Context

The Australian economy is experiencing a period of subdued demand growth and moderate employment growth. The RBA's stance on monetary policy is currently restrictive, aimed at establishing a more sustainable balance between demand and the economy's supply capacity. This approach is expected to continue until inflation returns to the target range, anticipated to be around 2025-2026.

Impact on the Australian Dollar (AUD)

The AUD has shown some resilience ahead of the RBA's decision, partly due to improved Purchasing Managers Index (PMI) data. Australia's Judo Bank Services and Composite PMIs rose to 51.0 and 50.2, respectively, in October, indicating a slight improvement in economic activity.

However, the AUD's performance is also influenced by external factors, such as the health of the Chinese economy, Australia's largest trading partner. Positive or negative surprises in Chinese growth data can directly impact the AUD's value.

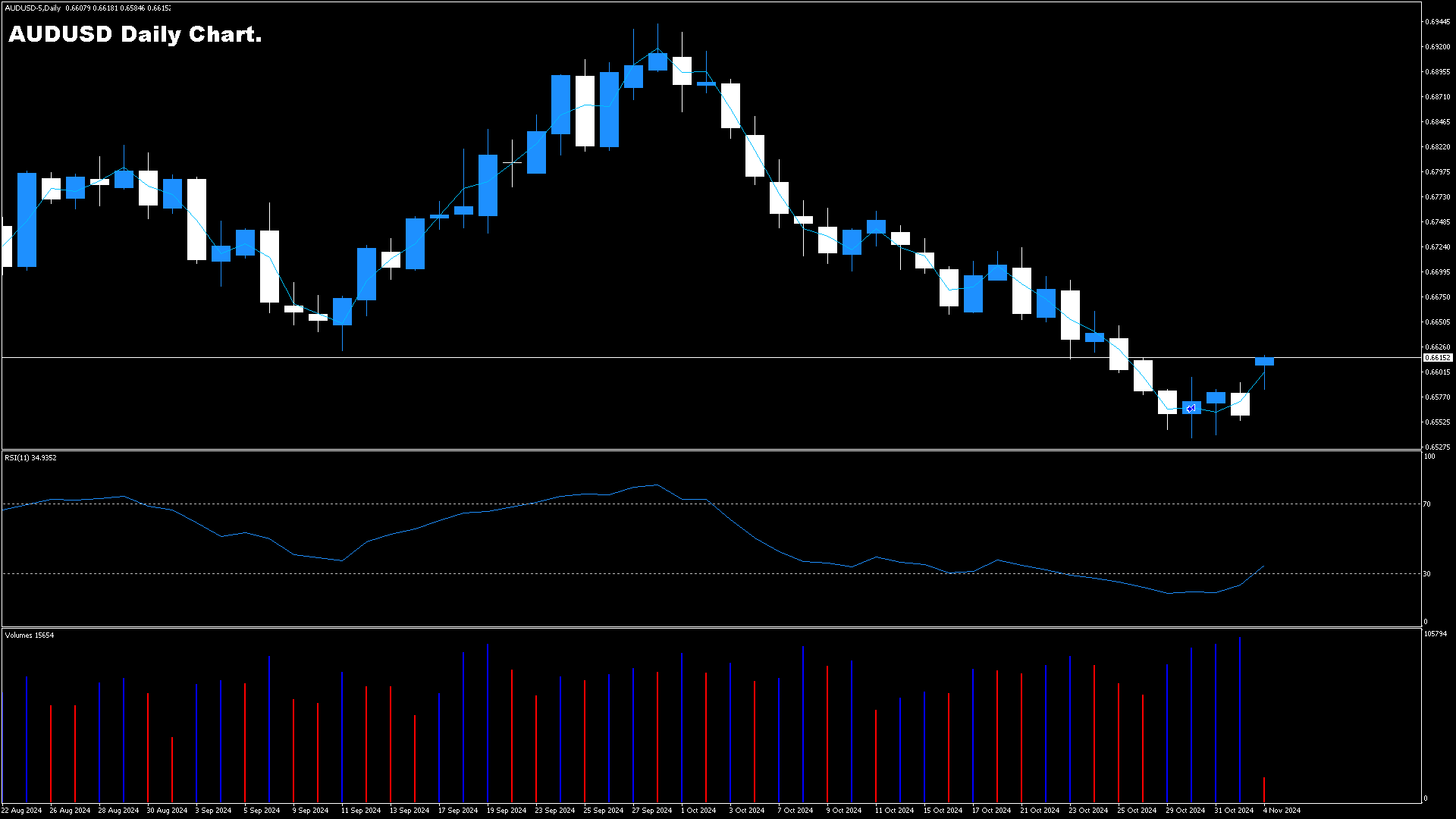

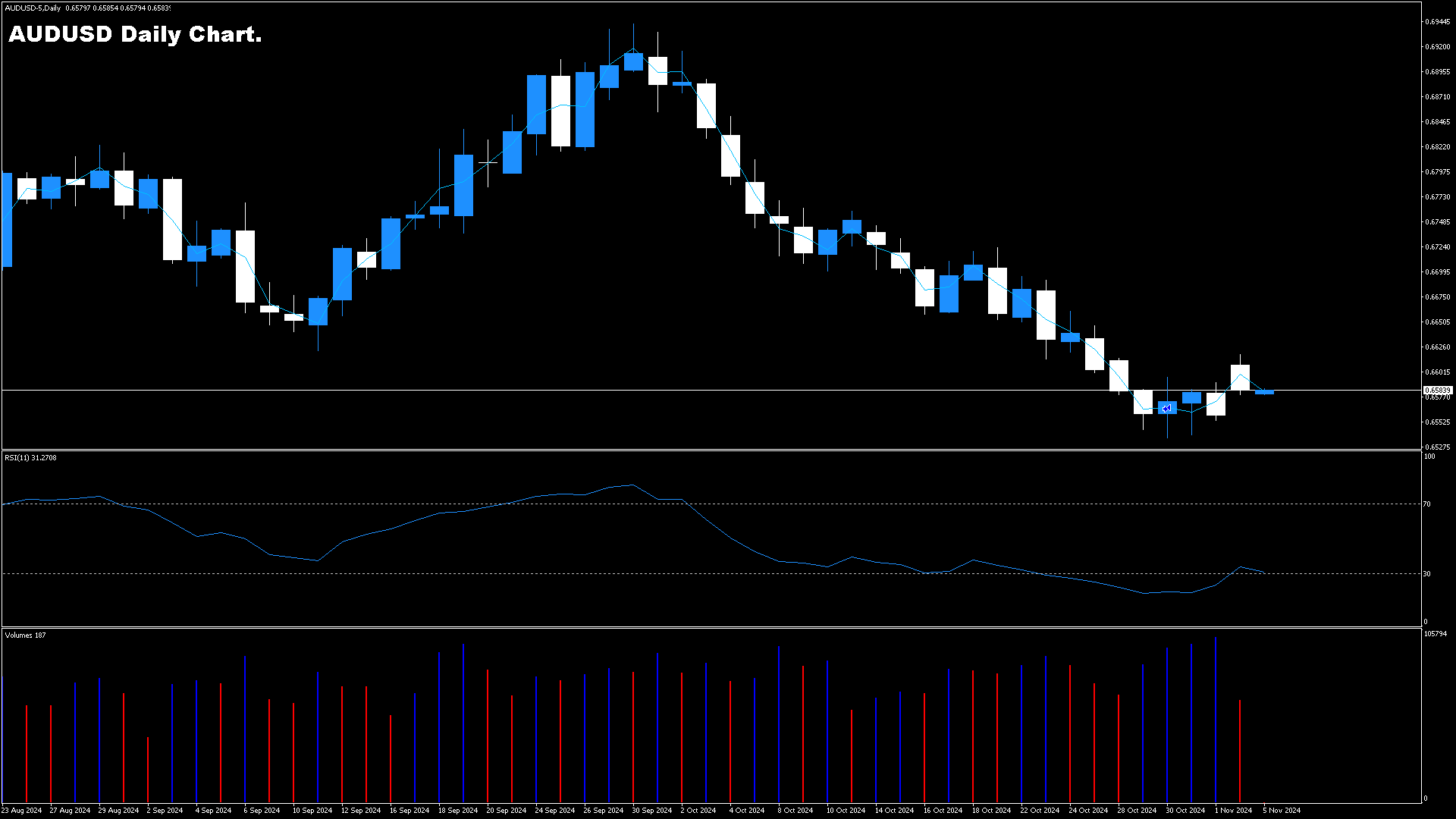

Technical Analysis

From a technical perspective, the AUD/USD pair is currently trading near 0.6590, testing the nine-day Exponential Moving Average (EMA). The 14-day Relative Strength Index (RSI) remains below 50, indicating a persistent bearish outlook. Immediate resistance levels are at the nine-day EMA (0.6596) and the 14-day EMA (0.6618), while support levels are around the three-month low at 0.6536 and the key psychological support at 0.6500.

For a sustained recovery, buyers need to push the AUD/USD above the 200-day Simple Moving Average (SMA) at 0.6629, with potential upside targets at 0.6700 and the 50-day SMA at 0.6730. Conversely, if the RBA hints at a potential rate cut, the pair could witness a sharp sell-off toward 0.6500.

Governor Michele Bullock's Press Conference

Following the interest rate decision, market attention will shift to Governor Michele Bullock’s press conference. Her comments and the RBA’s updated economic forecasts will be closely monitored for any hints on the timing of the first interest rate cut since the post-COVID tightening cycle. If the RBA indicates a possibility of a rate cut, it could lead to a sell-off in the AUD, while a cautious stance maintaining current rates could support the AUD's recovery.

Conclusion

The upcoming RBA decision on the OCR is a critical event that will shape the trajectory of the Australian economy and the AUD in the near term. With the cash rate expected to remain unchanged, the focus will be on the RBA's economic forecasts and Governor Bullock's comments. Traders and investors should be prepared for potential volatility in the AUD/USD pair based on these announcements, and any surprises in the RBA's stance could significantly impact market sentiment and trading strategies.