Upcoming Canadian Consumer Price Index (CPI): What to Expect and Its Impact on the Forex Market

As we approach the release of the Canadian Consumer Price Index (CPI) for September 2024, market participants are eagerly anticipating the data to gauge the current state of inflation and its implications for monetary policy and the forex market.

Expected CPI Figures

The latest forecasts suggest that the year-over-year headline CPI is likely to ease further, dropping to 1.8% in September from the 2.0% recorded in August.

On a monthly basis, the CPI is expected to remain relatively stable, with a minimal increase or potentially no change, following the 0.2% monthly decline observed in August.

Key Drivers of the CPI

Several factors are contributing to the anticipated slowdown in inflation:

Gasoline Prices

The decline in gasoline prices has been a significant contributor to the slowdown in headline inflation. In August, gasoline prices fell 5.1% year-over-year, largely due to lower crude oil prices and economic concerns in the U.S. and China.

Mortgage Interest Costs

Although mortgage interest costs continue to rise, the pace of this increase has been slowing. In August, the mortgage interest cost index rose by 18.8% year-over-year, down from the peak of 30.9% in August 2023. Despite this slowdown, mortgage interest costs remain a major contributor to the overall CPI increase.

Clothing and Footwear

Prices for clothing and footwear have been declining, with an unusual drop of 0.6% on a month-over-month basis in August. This decline is part of an eight-month trend of falling prices in this category, reflecting weaker consumer demand and increased discounts by retailers.

Economic and Monetary Policy Implications

The easing inflationary pressures have significant implications for the Canadian economy and monetary policy:

Interest Rate Decisions

A lower CPI could reduce the pressure on the Bank of Canada (BoC) to maintain or increase interest rates. Given the current economic slowdown, the BoC might consider accelerating the pace of interest rate cuts to stimulate economic growth. The recent 50 basis point rate cut by the U.S. Federal Reserve and the BoC's willingness to diverge from the Fed when necessary add to the speculation around potential rate adjustments.

Employment and Economic Growth

The September jobs report and the BoC’s Business Outlook Survey will also be closely watched. Weak job growth, rising unemployment rates, and declining job vacancies suggest a slowing economy. These indicators will help the BoC assess whether the economic slowdown is more pronounced than needed to bring inflation sustainably back under the 2% target.

Impact on the Forex Market

The Canadian CPI release has a direct impact on the value of the Canadian dollar (CAD) in the forex market:

Interest Rate Expectations

A lower-than-expected CPI could lead to a decrease in interest rates, making the CAD less attractive to investors seeking higher returns. This could result in a decrease in demand for the CAD, potentially causing the currency to drop in value against other major currencies like the USD.

Market Sentiment

The CPI release also influences public perception of the Canadian economy. A lower CPI indicates a more controlled inflation environment, which can be seen as positive for the economy but may not necessarily boost the CAD if it suggests a weaker economic growth outlook. Conversely, if the CPI is higher than expected, it could indicate a stronger economy and potentially higher interest rates, making the CAD more attractive.

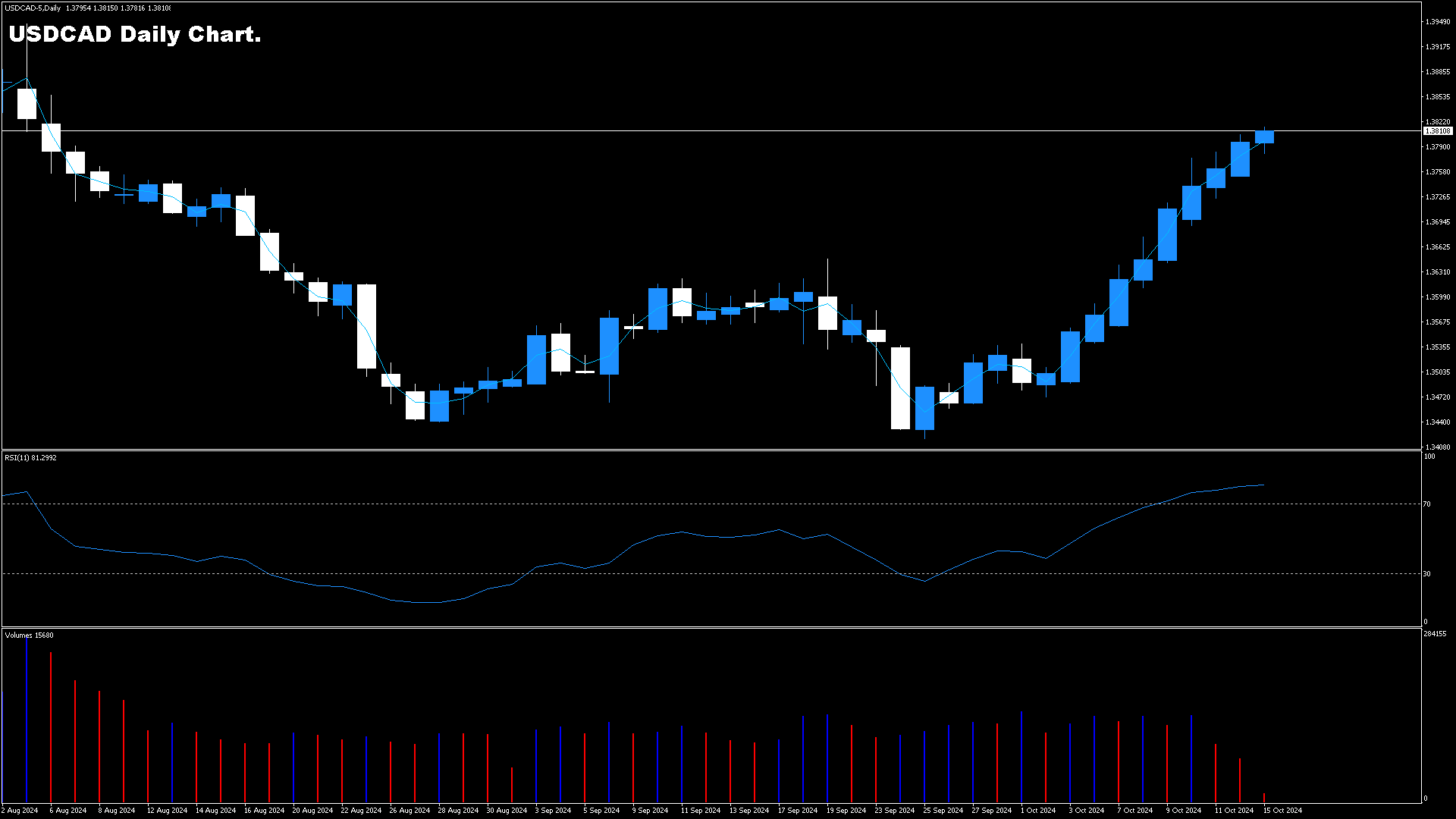

Technical Analysis of USD/CAD

In the lead-up to the CPI release, the USD/CAD currency pair has shown a monthly upswing, testing monthly highs. Technically, the pair is approaching resistance levels around C$1.3795 and has the potential to break out to higher levels if it surpasses these resistances. However, the daily Relative Strength Index (RSI) indicating overbought conditions and the H1 trendline support around C$1.38 will be crucial in determining short-term direction.

Conclusion

The upcoming Canadian CPI release for September 2024 is a critical event for forex traders and economists. With expectations of easing inflationary pressures, the data will provide valuable insights into the BoC's future monetary policy decisions and the overall health of the Canadian economy. Traders should closely monitor the release and its subsequent impact on the CAD, as it could lead to significant movements in the forex market.