Upcoming Australia Consumer Price Index (CPI) QoQ: Key Insights and Market Implications

On Tuesday, October 29, 2024, at 00:30 GMT, the Australian Bureau of Statistics (ABS) will release the quarterly Consumer Price Index (CPI) for the third quarter of 2024. This data is highly anticipated by economists, traders, and policymakers, as it provides a critical snapshot of inflation trends in Australia.

Understanding the Australian CPI

The Australian CPI measures the changes in prices of a fixed basket of goods and services acquired by Australian households. It is compiled according to international standards and is based on robust data collection and compilation methodologies. The CPI has undergone significant changes over the years, notably since the September quarter of 1998, when its principal purpose shifted from wage indexation to supporting macro-economic policy decision-making.

Recent Inflation Trends

The latest available data from the ABS indicates that the monthly CPI indicator rose 2.7% in the 12 months to August 2024, down from a 3.5% rise in the 12 months to July. This decline suggests a moderation in inflationary pressures. Key sectors contributing to this trend include Housing, which saw a 2.6% increase, and Food and non-alcoholic beverages, which rose by 3.4%. Notably, the Transport sector experienced a -1.1% decline, partly offsetting the overall increase.

Forecast and Expectations

For the upcoming Q3 2024 CPI release, market expectations are closely aligned with the recent moderation in inflation. Analysts anticipate that the quarterly CPI could reflect a continued easing of inflationary pressures, potentially aligning with the Reserve Bank of Australia's (RBA) stance on interest rates. The RBA is widely expected to keep interest rates unchanged, given the mild inflation data observed in recent quarters.

Methodology and Data Collection

The ABS collects prices in each capital city through trained staff and utilizes transactions data, which has been increasingly integrated since the March quarter of 2014. This approach involves calculating product unit values from revenue and quantity sold, providing a more accurate representation of prices paid by consumers. The CPI calculation involves almost 900,000 separate price quotations each quarter, combined with actual expenditure data of Australian households.

Market Implications

The release of the Q3 2024 CPI data will have significant implications for the Australian dollar (AUD) and broader financial markets. Here are a few key points to consider:

- Interest Rate Decisions: A lower-than-expected CPI could reinforce the RBA's decision to maintain current interest rates, potentially leading to stability in the AUD.

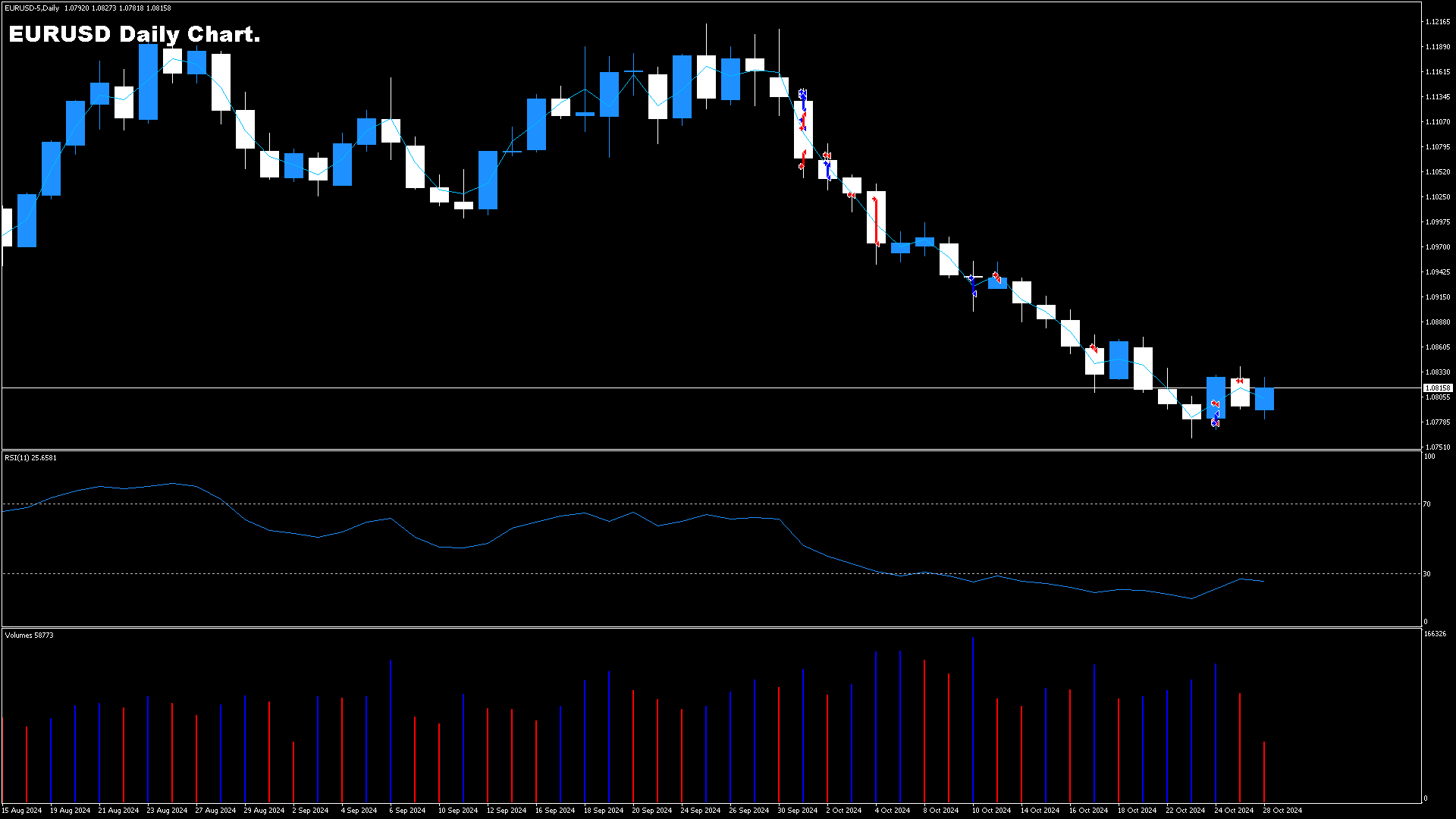

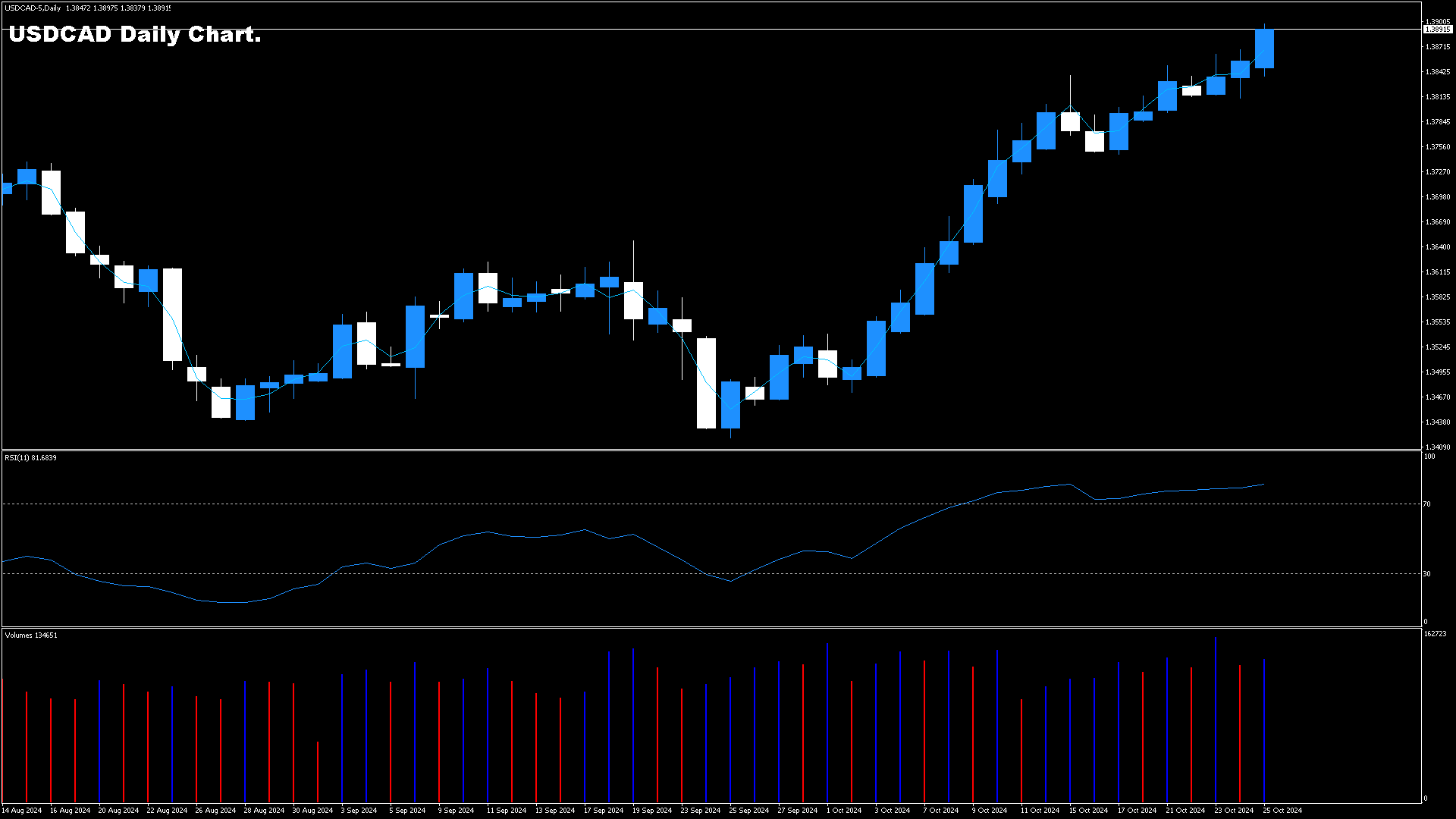

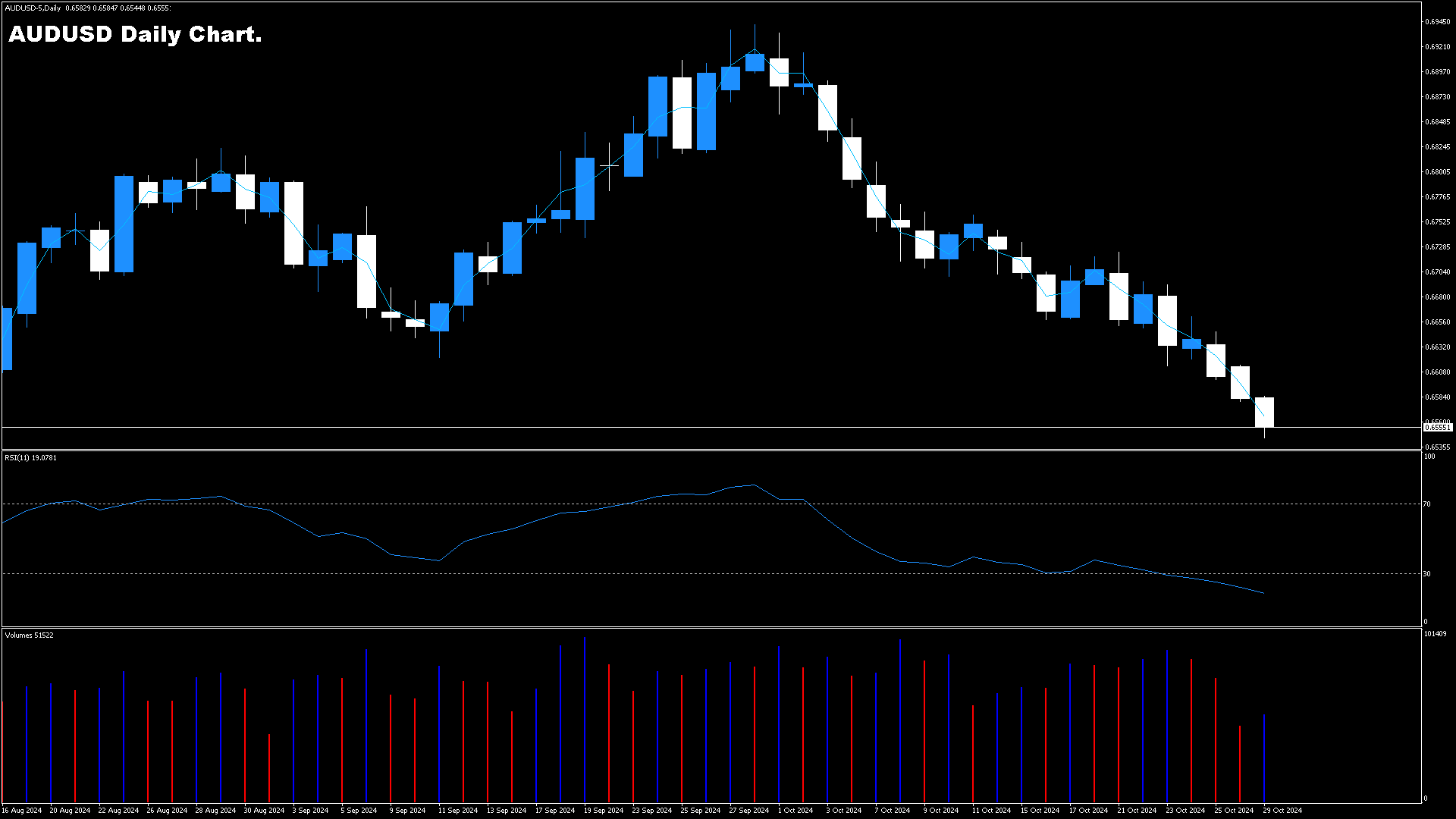

- Currency Markets: The AUD/USD pair may experience volatility based on the CPI figures. A higher-than-expected CPI could lead to a strengthening of the AUD, as it might suggest the need for future rate hikes.

- Economic Outlook: The CPI data will provide insights into the overall health of the Australian economy, influencing investor sentiment and potentially affecting equity and bond markets.

Trading Strategies

Traders should be prepared for potential market movements based on the CPI release:

- Short-term Volatility: Be prepared for immediate reactions in the AUD/USD and other AUD-crosses following the release.

- Technical Analysis: Monitor key support and resistance levels in the AUD/USD pair, as the CPI data could trigger significant price movements.

- Fundamental Analysis: Consider the broader economic context and how the CPI data aligns with or diverges from market expectations.

In conclusion, the upcoming Q3 2024 Australian CPI release is a pivotal event that will offer valuable insights into the country's inflation landscape. Traders, investors, and policymakers will closely watch this data to gauge the direction of monetary policy and the overall economic health of Australia. As always, staying informed and adapting trading strategies based on real-time data will be crucial in navigating the potential market implications of this release.