The Upcoming USD ADP Non-Farm Employment Change: What You Need to Know

As we approach the release of the ADP Non-Farm Employment Change report, traders, investors, and economists are eagerly anticipating the data, which is set to provide crucial insights into the health of the U.S. labor market and its potential impact on the US Dollar (USD).

Understanding the ADP Non-Farm Employment Change

The ADP Non-Farm Employment Change report, produced by Automatic Data Processing (ADP), is a monthly indicator that measures the change in the number of non-farm, private sector jobs in the United States. This report is compiled from payroll data of approximately 400,000 U.S. business clients, making it a significant and reliable predictor of the government's Nonfarm Payrolls (NFP) report, which is released two days later.

Importance of the ADP Report

The ADP Non-Farm Employment Change is a key economic indicator that carries substantial weight in economic analyses and predictions. Here are several reasons why this report is so important:

- Economic Growth: An increase in non-farm jobs indicates a healthy and growing economy, as it reflects higher economic activity and productivity. This can lead to increased consumer spending and aggregate demand, further boosting economic growth.

- Monetary Policy: Strong employment data directly influences the Federal Reserve's monetary policy decisions. A robust job market may prompt the Fed to raise interest rates to prevent the economy from overheating and to keep inflation in check. Higher interest rates typically attract foreign investments, leading to an appreciation of the USD.

- Market Sentiment: The financial market closely watches employment data to anticipate future interest rate decisions. Positive employment reports can lead to expectations of an interest rate hike, which in turn can boost the value of the USD. Conversely, weak employment data may lead to expectations of interest rate cuts, potentially weakening the USD.

Recent Trends and Expectations

The most recent ADP report, released on October 2, 2024, showed a significant increase in job creation, with 143,000 jobs added, surpassing the forecasted 124,000. This figure was also higher than the previous month's 103,000, indicating a continued upward trend in job creation and reinforcing the strength of the U.S. economy.

Given this context, the upcoming report is expected to be closely scrutinized for any signs of continued strength or potential weaknesses in the labor market. If the data exceeds expectations, it could further bolster investor confidence in the USD, while a weaker-than-expected reading could lead to a decline in the dollar's value.

Impact on the US Dollar

The ADP Non-Farm Employment Change has a direct and significant impact on the USD in several ways:

- Immediate Market Reaction: A higher-than-expected increase in non-farm employment is generally seen as a positive sign for the U.S. economy, leading to an increase in demand for the USD and potentially causing the currency to appreciate in the forex market. Conversely, a weaker-than-expected number could lead to decreased demand and a depreciation of the USD.

- Long-term Effects: The data from the ADP report can influence long-term decisions made by the Federal Reserve, particularly regarding interest rates. Strong job market data could lead to higher interest rates, attracting more foreign investment and further strengthening the USD.

Trading Strategies

For traders, the ADP Non-Farm Employment Change report presents both opportunities and risks. Here are some key strategies to consider:

- Positioning Ahead of the Report: Traders often position themselves based on market expectations versus actual outcomes. If the consensus forecast is for a moderate increase, a significantly higher number could lead to a bullish reaction in the USD, while a lower number could result in a bearish reaction.

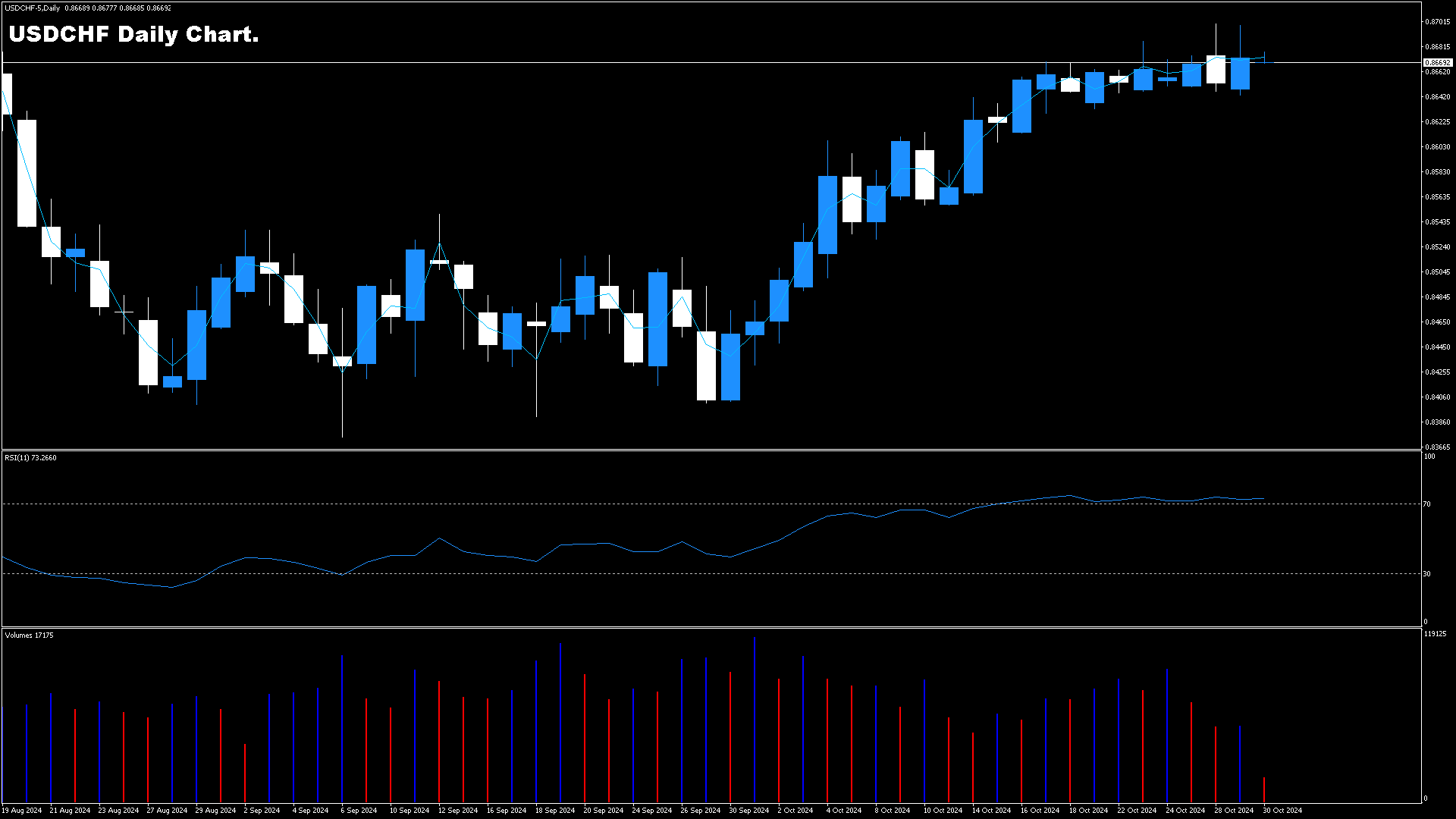

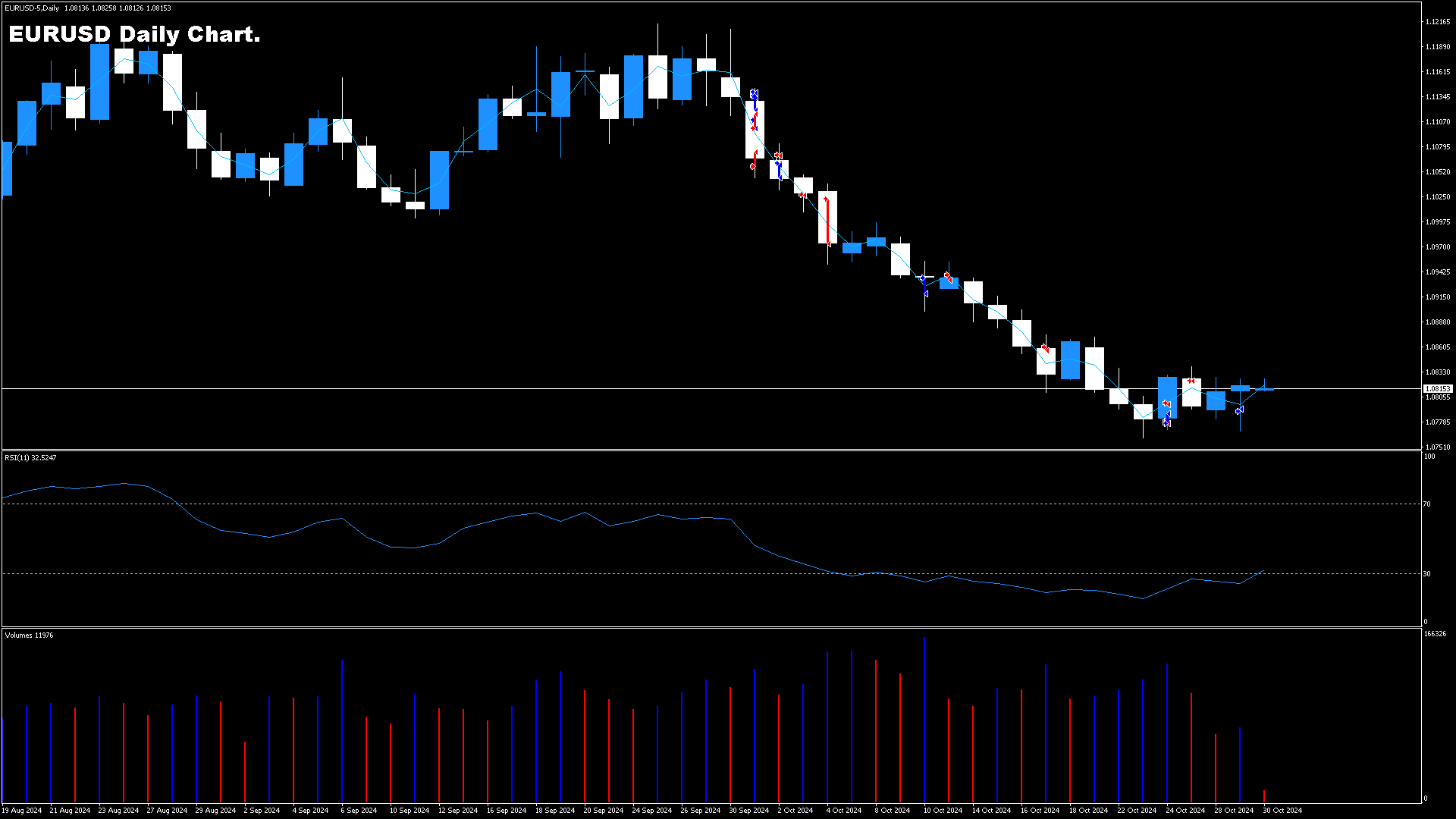

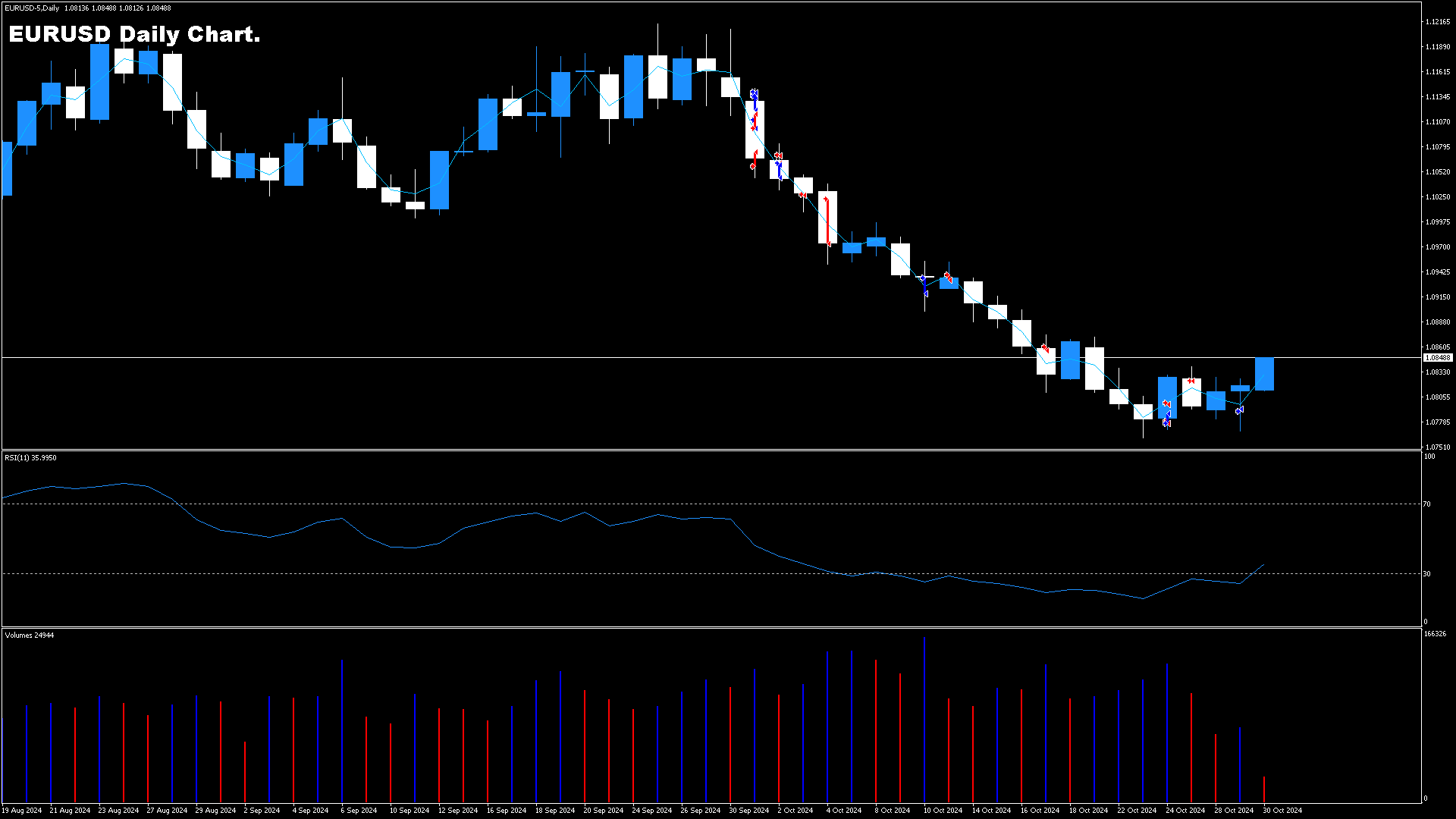

- Technical Analysis: The report's release can lead to significant market movements. Traders should be prepared to react to any surprises in the data, using technical indicators such as moving averages and resistance levels to guide their decisions.

Conclusion

The upcoming ADP Non-Farm Employment Change report is a critical event in the economic calendar, offering valuable insights into the U.S. labor market and its implications for the USD. With its potential to influence monetary policy, economic growth, and market sentiment, this report is a must-watch for anyone involved in forex trading or economic analysis. As the data is released, traders and investors will be closely monitoring the figures to make informed decisions and adjust their strategies accordingly.