The Upcoming USD Federal Funds Rate: Navigating the Shifting Monetary Landscape

As we approach the next Federal Open Market Committee (FOMC) meeting, the financial community is abuzz with anticipation regarding the potential adjustments to the USD Federal Funds Rate. Here’s a comprehensive analysis of the current economic landscape and the implications of the expected rate changes.

Current Economic Context

The U.S. economy has been navigating a complex mix of strong labor market indicators and declining inflation rates. Despite the labor market remaining extraordinarily strong, with unemployment rates averaging just below 4% and nominal wage growth at 3.8%, there are signs of a slight softening on the margins.

Inflation, which had been a significant concern post-pandemic, has been retreating from elevated levels. The current inflation rate stands at 2.6%, down from the peak in 2022, and is moving closer to the Federal Reserve's 2% target.

The Case for Rate Cuts

Several key indicators suggest that the current federal funds rate, hovering between 5.25% and 5.5%, is overly contractionary. This rate is significantly higher than the estimated neutral rate, which is generally considered to be between 2.5% and 3.5%.

The high interest rates have made borrowing expensive for businesses and consumers, potentially stifling economic growth and pushing the economy towards an unnecessary recession. The real federal funds rate, adjusted for inflation, stands at around 3%, which is still above the preferred estimate of the neutral rate.

Federal Reserve's Stance

Federal Reserve Chair Jerome Powell has signaled a shift in focus towards maintaining economic stability in the face of a softening economy. Powell highlighted that the upside risks to inflation have diminished, while risks to economic and employment growth have risen. This suggests that the Fed is likely to reduce short-term interest rates to balance the risks between inflation and unemployment.

Expected Rate Cuts

The market is pricing in a high probability of a rate cut at the upcoming FOMC meeting, with a 62% chance of a 50 basis-point cut and a significant likelihood of further cuts later in the year.

Cutting the federal funds rate by at least 2 percentage points over the next year is seen as a necessary step to move closer to a neutral stance. A 50 basis-point cut this week would be a significant move in this direction, aligning with the Fed’s goal of achieving a fully neutral stance by summer 2025.

Implications for the Economy and Markets

A reduction in the federal funds rate would have several key implications:

Consumer and Business Borrowing: Lower interest rates would make borrowing cheaper, encouraging consumer spending and business investment. This could lead to lower interest rates on mortgages, car loans, and credit cards, making it more affordable for consumers to borrow and spend.

Economic Growth: Lower borrowing costs for businesses could stimulate economic growth by encouraging expansion and new hiring. This, in turn, could help prevent an economic recession while not reigniting inflation.

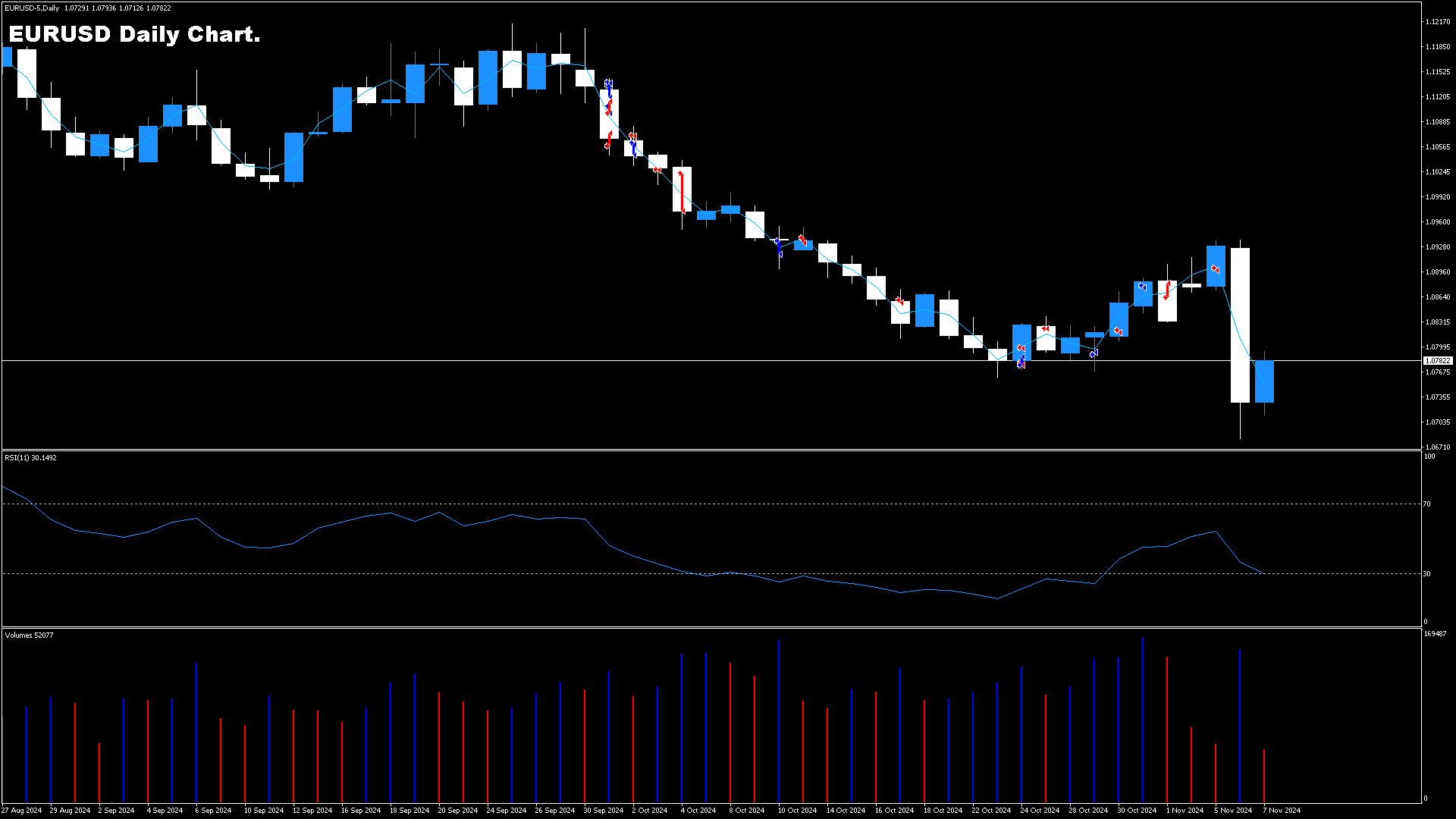

Financial Markets: A rate cut is generally viewed positively by investors, as it improves the outlook for economic growth and corporate profitability. This could drive up stock prices and improve market sentiment.

Conclusion

The upcoming decision on the USD Federal Funds Rate is pivotal in navigating the current economic landscape. With the labor market strong but showing signs of softening, and inflation retreating towards the Fed’s target, there is a compelling case for reducing the overly contractionary interest rates.

As the Fed embarks on this easing journey, the path ahead will be guided by incoming economic data. The goal is clear: to balance the risks between inflation and employment, ensuring that the economy remains on a sustainable growth trajectory without slipping into recession.

Investors, businesses, and consumers alike should be prepared for the potential benefits and challenges that these rate adjustments will bring, as the Fed works to achieve a more neutral monetary policy stance.