Upcoming NZD Inflation Expectations q/q: Implications for the New Zealand Dollar and Monetary Policy

As the financial markets prepare for the release of the New Zealand's quarterly inflation expectations, it is crucial to understand the significance of this economic indicator and its potential impact on the New Zealand dollar (NZD) and the country's monetary policy.

What are NZD Inflation Expectations?

The NZD Inflation Expectations, released by the Reserve Bank of New Zealand (RBNZ) on a quarterly basis, measure business managers' expectations of annual Consumer Price Index (CPI) two years into the future. This forecast provides valuable insights into the future trends of inflation and is a key factor in shaping market perceptions of the New Zealand economy[2][3].

Recent Trends and Implications

In the latest release, inflation expectations dropped from 2.33% to 2.03%, indicating a decline in anticipated inflationary pressures over the next two years. This downward trend, observed since August 2023 when the forecast was at 2.83%, suggests that inflationary pressures may be subsiding, potentially reducing the need for further interest rate increases[1][4].

Impact on Monetary Policy

The RBNZ closely monitors these inflation expectations as they can translate into real inflation. When inflation expectations rise, the central bank may increase interest rates to curb inflation. Conversely, if expectations decline, the RBNZ may ease monetary policy. The recent drop in inflation expectations could prompt the RBNZ to adopt a more conservative stance towards raising interest rates, which could negatively affect the value of the NZD in the short term[1][4].

Effect on the New Zealand Dollar

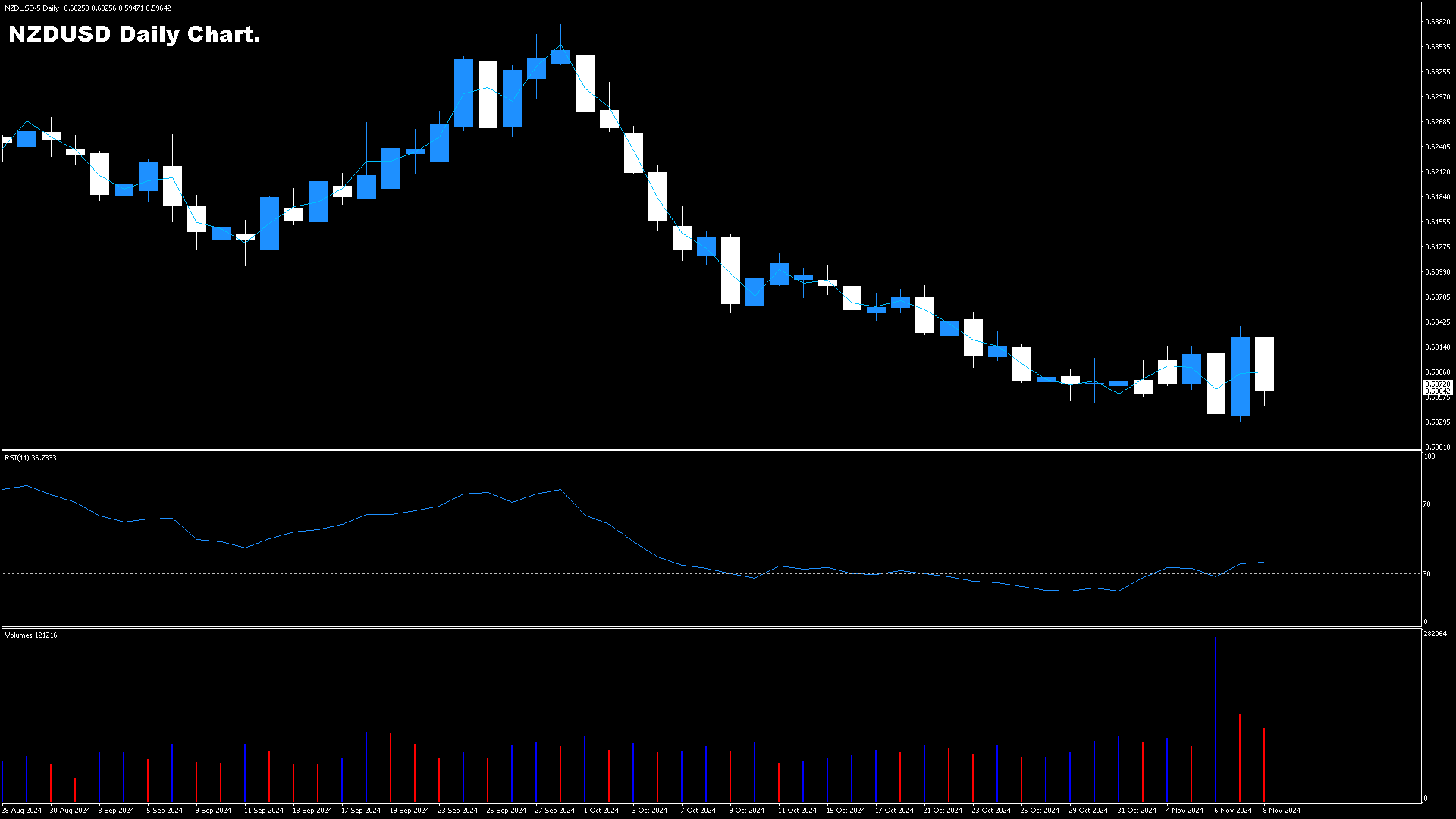

The value of the NZD is significantly influenced by interest rate changes set by the RBNZ. Higher interest rates attract foreign investors seeking higher returns, thereby increasing demand for the NZD and enhancing its value. However, with declining inflation expectations and the potential for eased monetary policy, the NZD may face downward pressure. Despite a recent marginal gain, the NZD's long-term trajectory could be influenced by these monetary policy decisions[1][4].

Market Reaction and Technical Analysis

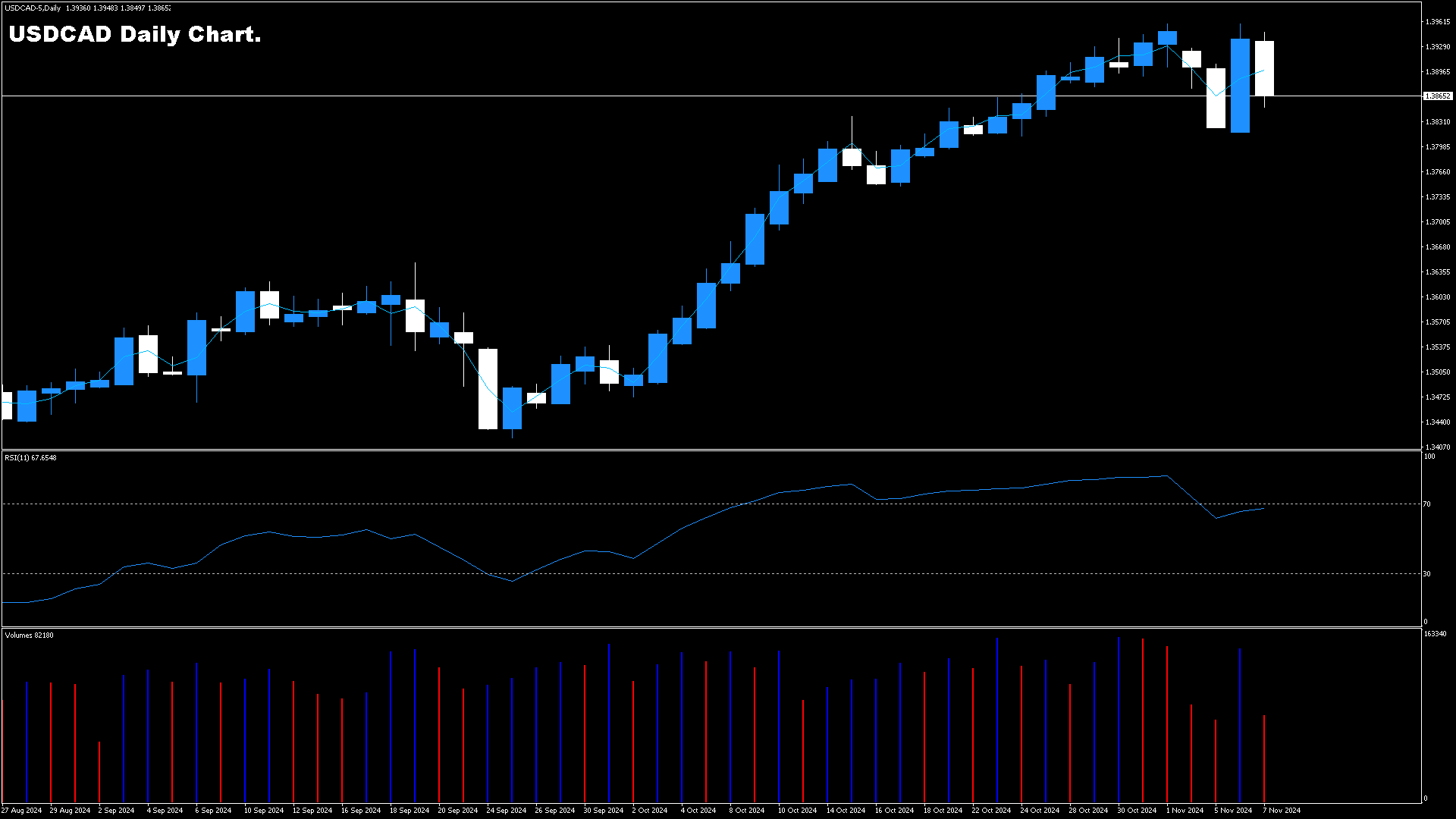

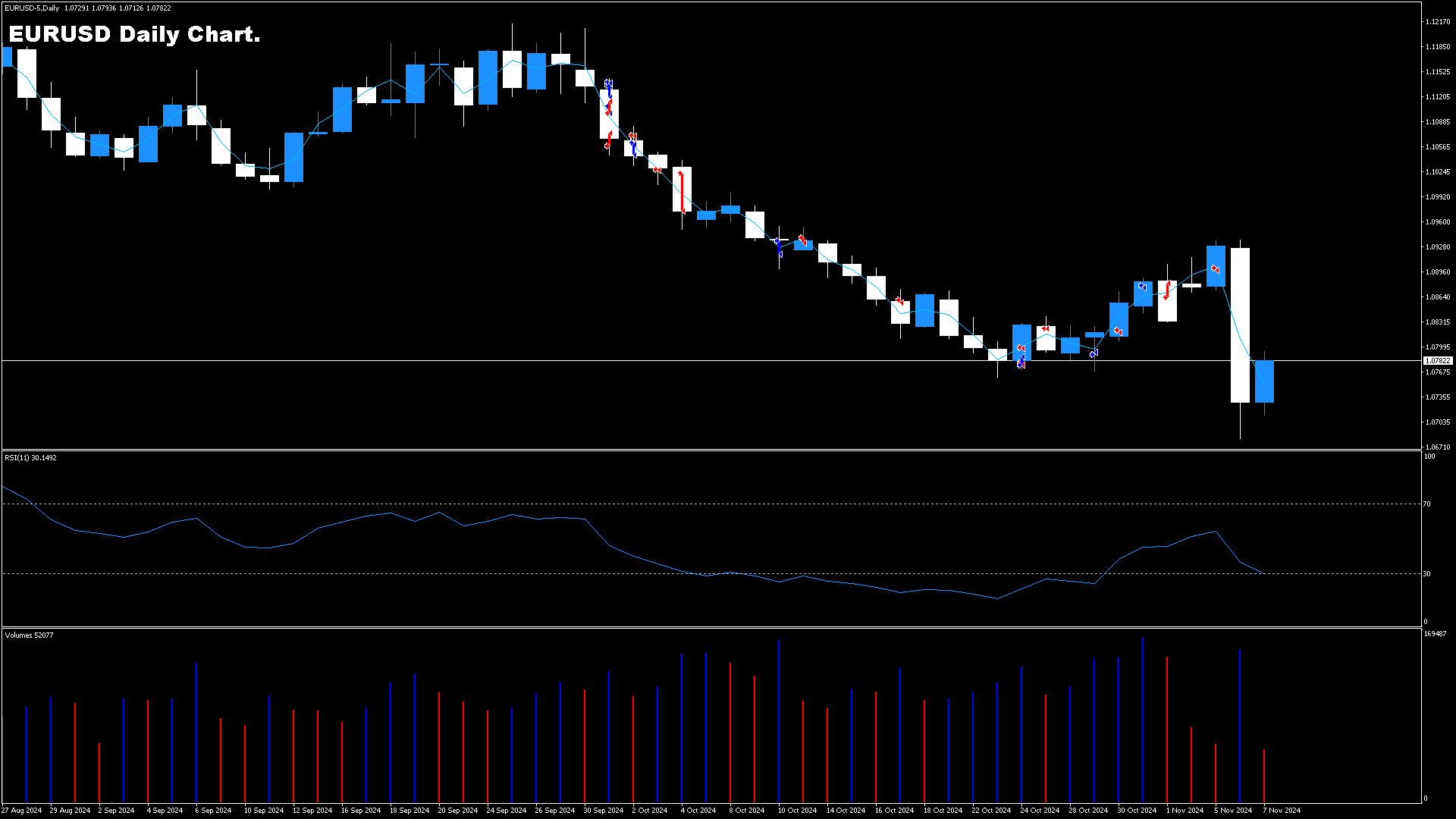

In the immediate aftermath of the last inflation expectations release, the NZD experienced volatility, rising as much as 1.2% before retracting. Currently, the NZD/USD is trading around 0.5998, with key support levels at 0.5988 and 0.5950, and resistance at 0.6032 and 0.6070. Traders should be cautious of these technical levels as the market adjusts to the new inflation expectations and anticipated monetary policy actions[4].

Economic Context

The broader economic context also plays a crucial role. New Zealand's inflation has been on a downward path, reaching 3.3% in the second quarter, its lowest level in three years and close to the upper limit of the RBNZ's target range of 1% to 3%. Additionally, manufacturing and services have contracted, and GDP has declined, indicating potential recessionary pressures. These factors, combined with the inflation expectations data, will be pivotal in the RBNZ's decision-making process regarding interest rates[4].

Conclusion

The upcoming release of the NZD Inflation Expectations q/q will be a critical event for traders and investors. A continued decline in inflation expectations could signal a more dovish stance from the RBNZ, potentially leading to a weaker NZD. However, the RBNZ must balance this with other economic indicators, such as employment and GDP data, to ensure that monetary policy decisions support both price stability and economic growth.

Traders should closely monitor the release and subsequent market reactions, considering both the technical levels and the broader economic context to make informed trading decisions. As always, careful analysis of the data and its implications for monetary policy will be essential in navigating the complexities of the forex market.