Upcoming GBP Retail Sales MoM: Key Insights and Market Implications

As we approach the release of the UK Retail Sales Month-over-Month (MoM) data for September 2024, scheduled for October 18, 2024, it is crucial to analyze the recent trends and factors that could influence the upcoming figures. Here’s a comprehensive overview to help traders and investors make informed decisions.

Recent Trends

The latest data for August 2024 showed a significant increase in retail sales volumes, with a 1.0% rise compared to the 0.7% growth in July 2024. This surge was notably higher than the long-term average of 0.21% and marked the highest index levels since July 2022.

Several factors contributed to this growth:

- Weather and Seasonal Sales: Warmer weather and end-of-season sales boosted sales in food and clothing sectors. Food stores saw a 1.8% increase, while non-food stores, particularly clothing retailers, experienced a 0.6% rise.

- Sector Performance: Department stores and sports equipment stores benefited from summer discounts and sporting events, such as the European football Championship.

Three-Month and Annual Perspectives

Over the three months to August 2024, retail sales volumes rose by 1.2% compared to the three months to May 2024. On an annual basis, sales volumes increased by 2.5%, the largest annual rise since February 2022.

Online Sales

While in-store sales showed robust growth, online sales remained flat in August 2024, with a 0.0% change. However, online spending values rose by 4.3% compared to August 2023. The proportion of sales made online slightly decreased from 27.8% in July to 27.6% in August.

Market Implications

The strong retail sales data for August suggests a resilient consumer sector in the UK, which could have positive implications for the British Pound (GBP). Here are a few key points to consider:

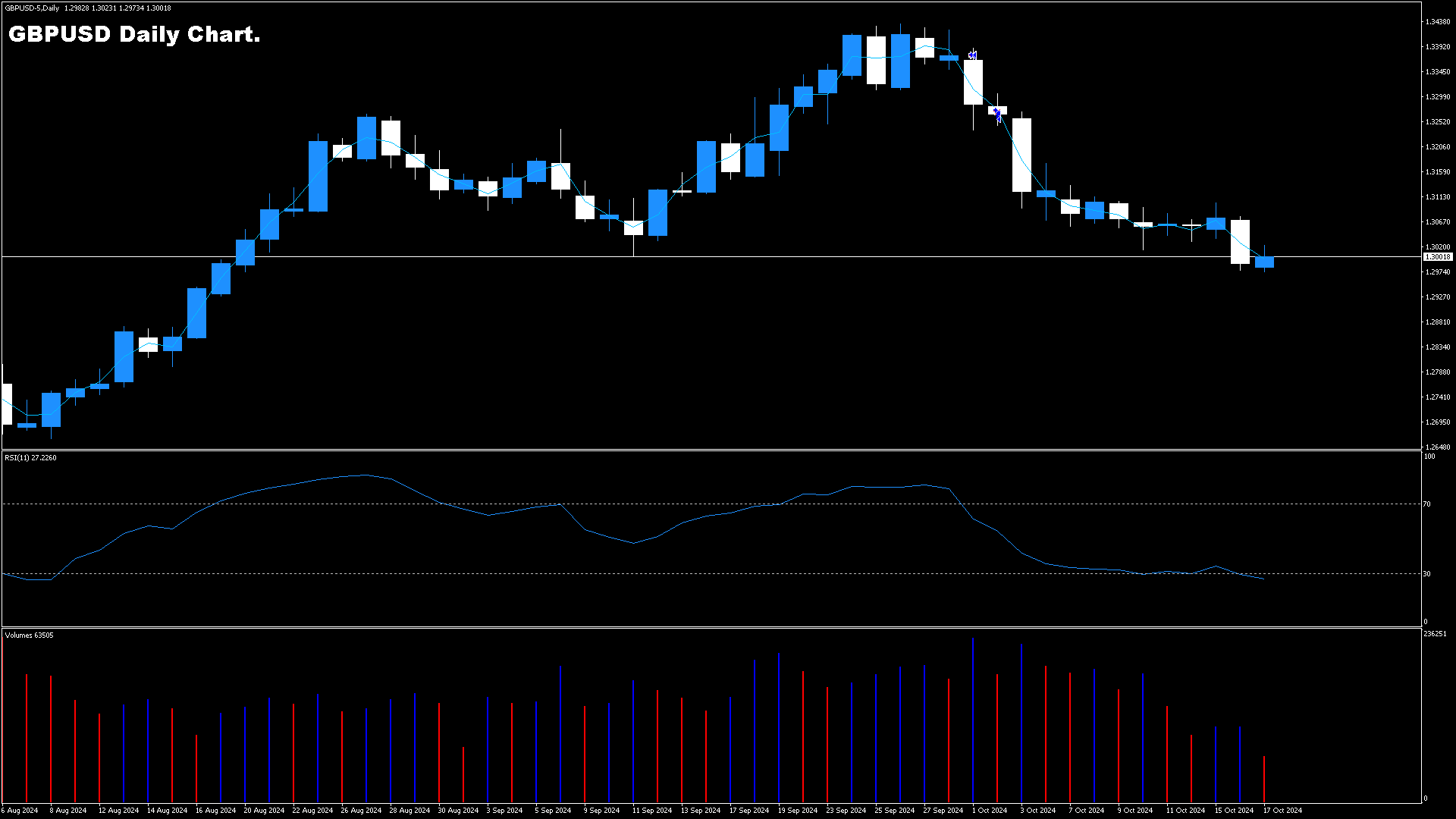

- Economic Growth: Robust retail sales are indicative of consumer confidence and spending power, which are crucial for overall economic growth. A continued upward trend could support a stronger GBP against other currencies.

- Interest Rates: Positive retail sales data may influence the Bank of England's monetary policy decisions. Strong consumer spending could justify higher interest rates to manage inflation, which in turn could strengthen the GBP.

- Market Sentiment: Investors and traders should be aware that strong retail sales can improve market sentiment towards the UK economy, potentially leading to increased demand for GBP.

Forecast and Trading Strategy

Given the recent trends, here are some points to consider for the upcoming September 2024 data:

- Expectations: If the current momentum continues, we might see another positive month for retail sales. However, any deviation from expectations could lead to significant market movements.

- Risk Management: Traders should be prepared for potential volatility around the data release. Setting appropriate stop-losses and taking positions based on a thorough analysis of historical data and current economic conditions is advisable.

- Correlated Assets: Keep an eye on other economic indicators and their impact on correlated assets such as the FTSE 100 index and UK government bonds.

Conclusion

The upcoming UK Retail Sales MoM data for September 2024 is a critical event that could significantly impact the GBP and broader market sentiment. With recent data showing strong consumer spending and a resilient retail sector, traders and investors should be prepared for potential market movements.

- Stay Informed: Keep track of pre-release forecasts and any revisions to previous data, as these can provide valuable insights into market expectations.

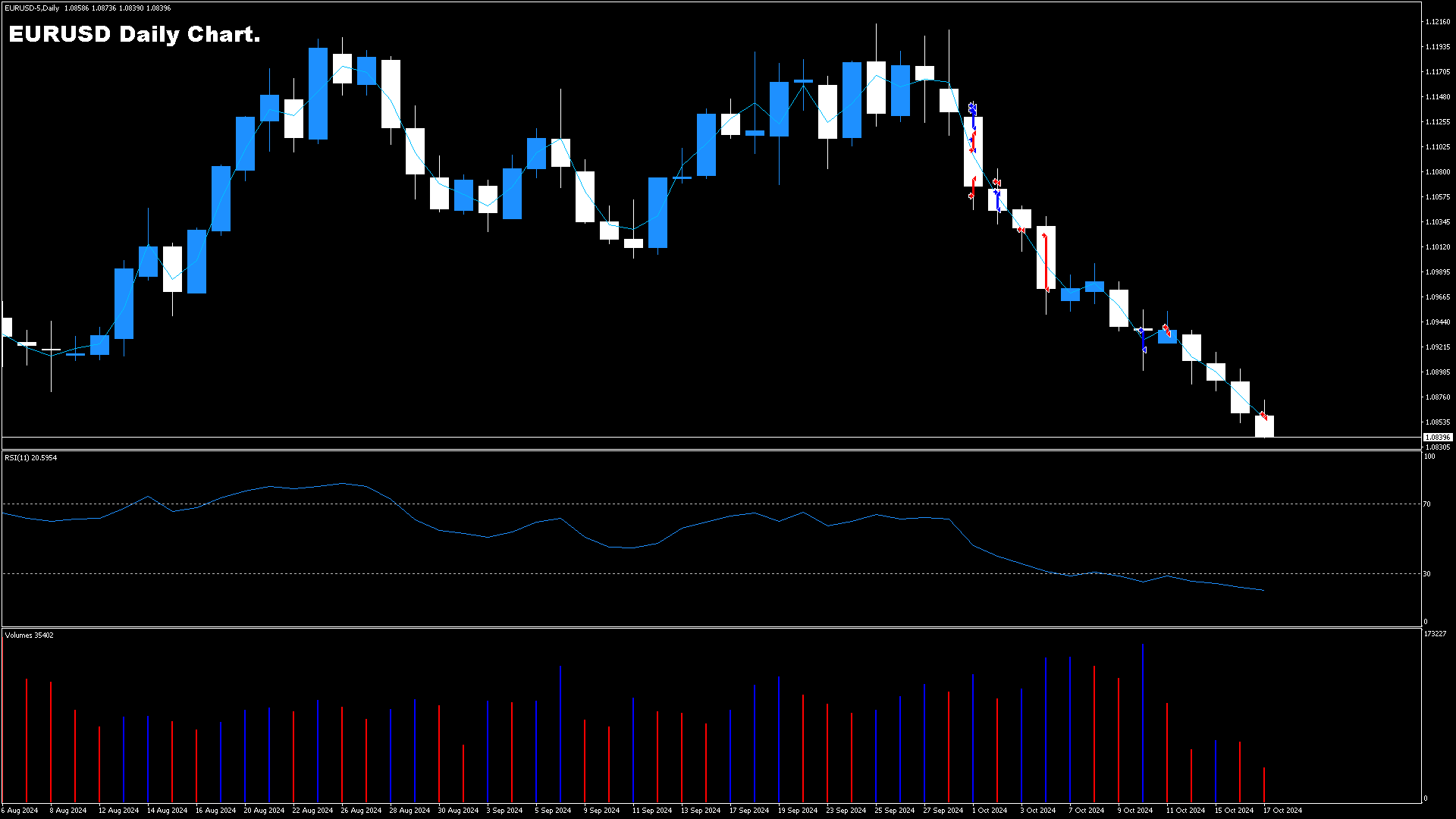

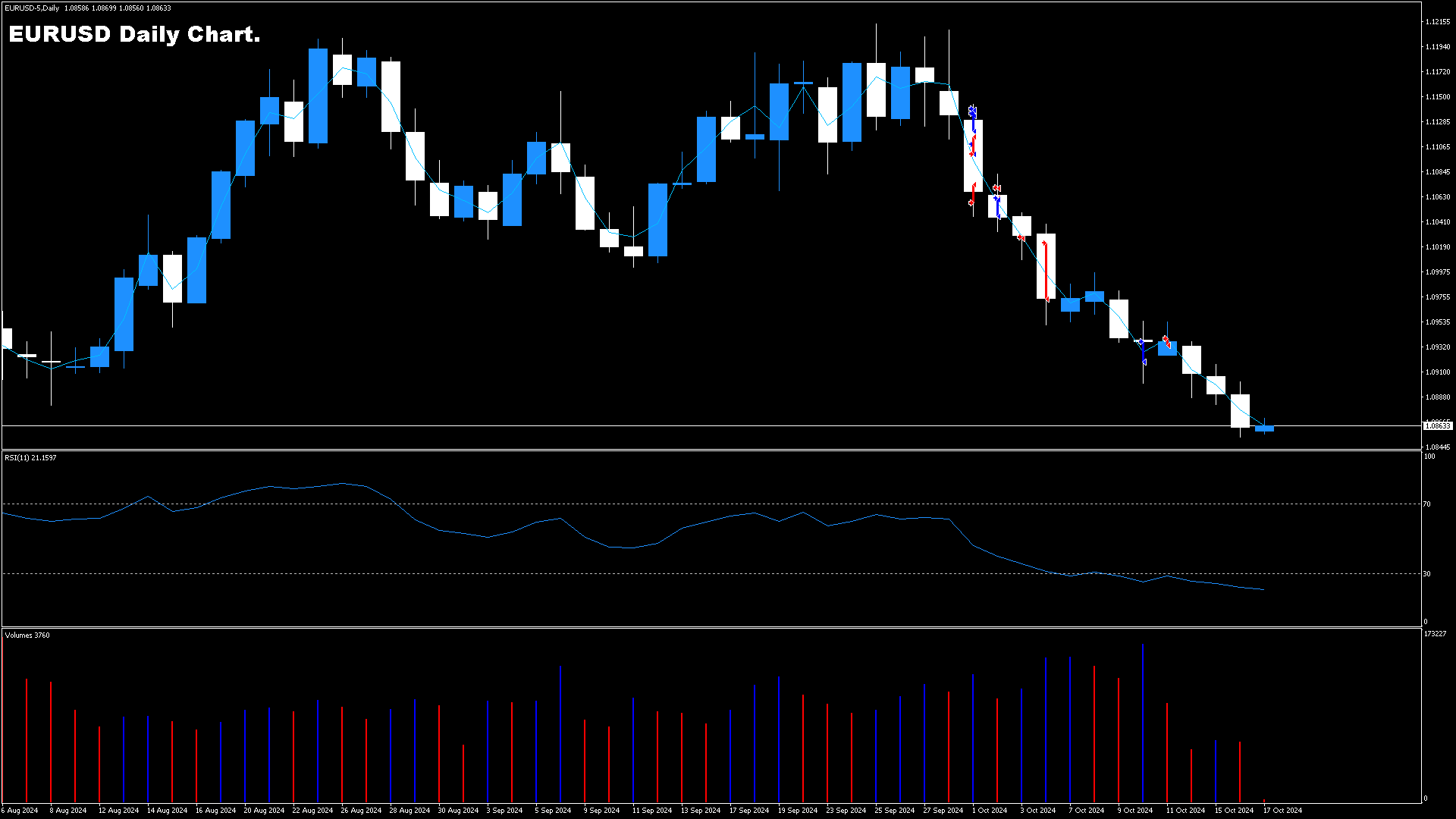

- Technical Analysis: Use technical indicators to identify potential support and resistance levels for GBP pairs, which can help in making timely trading decisions.

- Economic Context: Consider the broader economic landscape, including inflation rates, interest rate decisions, and other key indicators that could influence the retail sales data and subsequent market reactions.

By staying informed and analyzing the data comprehensively, traders and investors can make more informed decisions and navigate the market effectively.