Upcoming Bank of Japan (BOJ) Outlook Report: Key Expectations and Market Implications

As the Bank of Japan (BOJ) prepares to release its latest Outlook Report on October 31, 2024, market participants are eagerly anticipating the central bank's stance on monetary policy, economic forecasts, and the potential impact on the Japanese yen (JPY) and broader financial markets.

Monetary Policy Stance

The BOJ's recent monetary policy meeting, scheduled across October 30-31, 2024, is expected to maintain the current policy settings, with no immediate rate hikes anticipated. The central bank raised its short-term policy target to 0.25% in July, marking a shift from its previous zero-to-0.1% range, but has since adopted a more patient approach.

Despite some expectations for a rate hike by the end of 2024, the majority of economists and market analysts believe that the BOJ will keep rates unchanged at the upcoming meeting. This decision is influenced by the stable inflation rate around 2%, which aligns with the BOJ's forecasts, and the cautious approach due to uncertainties surrounding the upcoming US elections and recent political developments in Japan.

Economic Forecasts

The Outlook Report is expected to reaffirm the BOJ's positive outlook on Japan's economy. According to the July 2024 Outlook Report, Japan's economy is likely to continue growing at a pace above its potential growth rate, supported by moderately growing overseas economies and accommodative financial conditions.

Inflation is projected to remain around 2.5% for fiscal 2024 and then stabilize at approximately 2% from fiscal 2025 onwards. Underlying CPI inflation, excluding temporary fluctuations, is expected to increase gradually and align with the BOJ's 2% price stability target.

Market Implications

Currency Markets

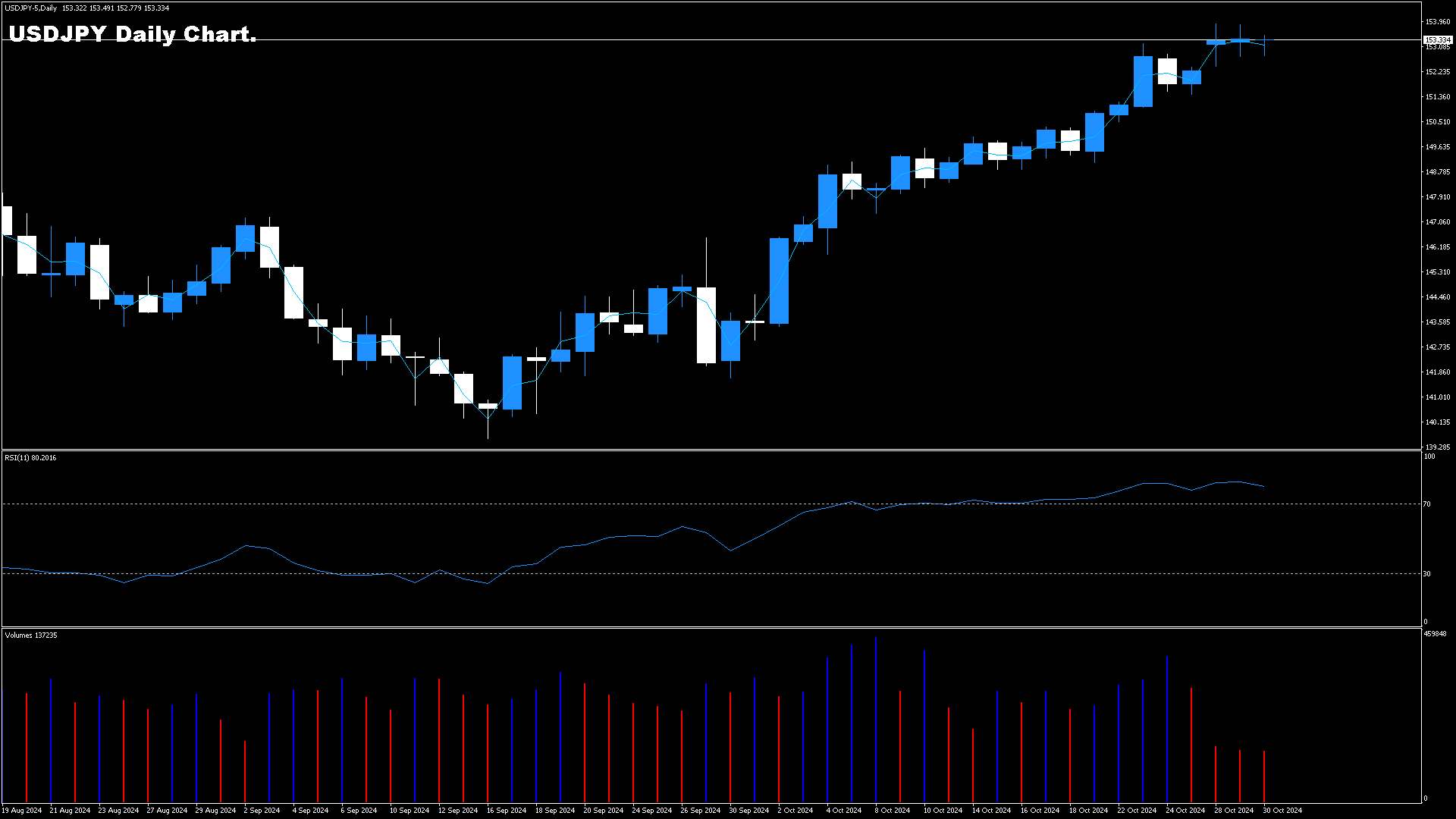

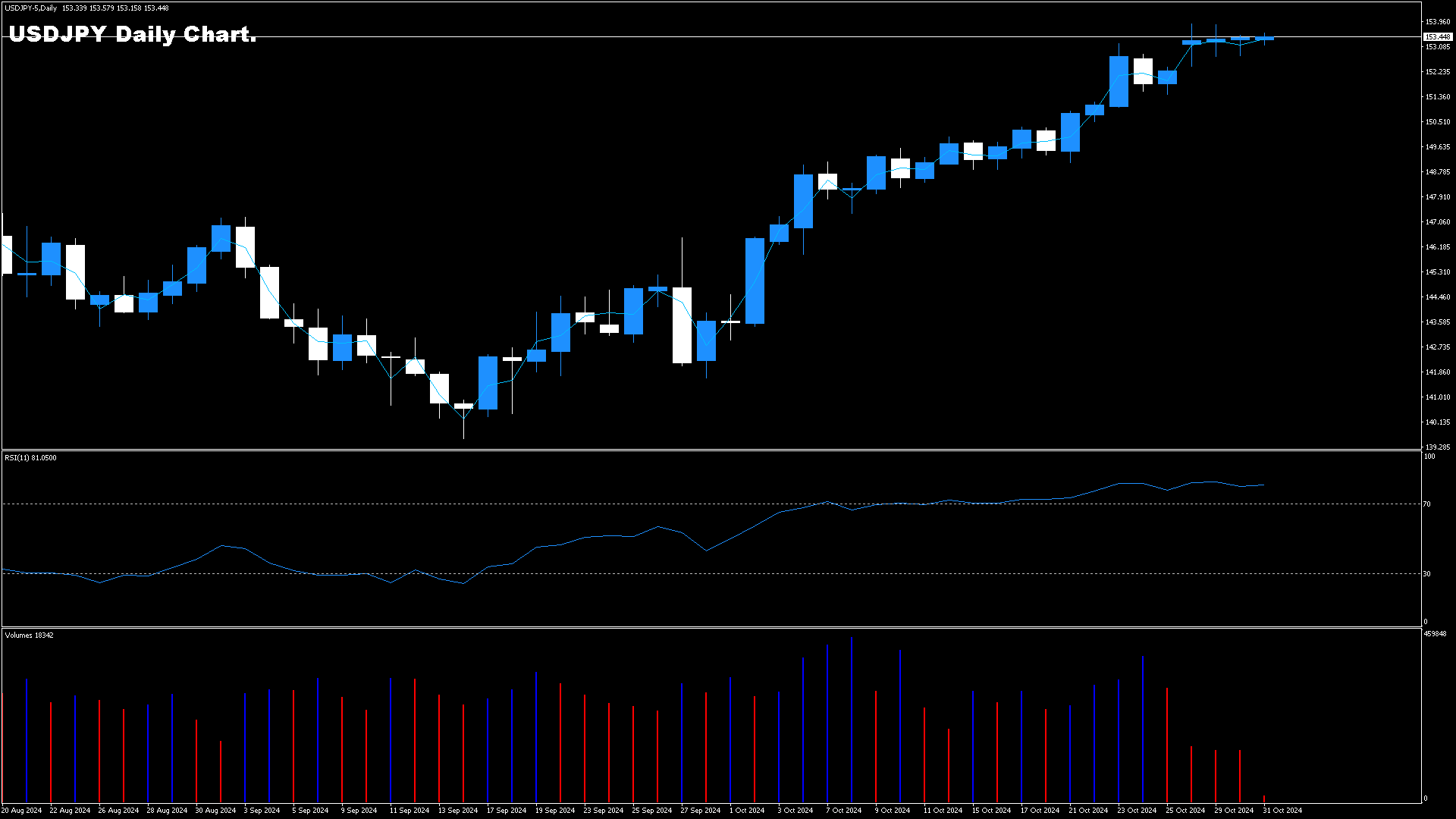

The USD/JPY pair has recently surged to a three-month high, driven by the widening US-Japan bond yield differentials and the Federal Reserve's hawkish stance contrasting with the BOJ's more dovish approach. Any dovish cues from the BOJ meeting could maintain or even strengthen this trend, potentially pushing the USD/JPY pair towards the 154.90 level. However, a close below the recent lows could signal a reversal, with support expected around the 149.20 level.

Equity Markets

The Nikkei 225 index, despite its recent rollover after touching a three-month high, may find support from an upward trendline connecting higher lows since February 2023. A dovish takeaway from the BOJ meeting could be supportive of Japanese equities, although risk-taking may remain limited due to US election uncertainties.

Policy Guidance and Future Rate Hikes

The BOJ's Governor, Kazuo Ueda, has emphasized the central bank's data-dependent approach and the need to sustainably achieve the 2% inflation target. While there are expectations for a rate hike by the end of 2024, particularly in December, many analysts now see the next move more likely in the first quarter of 2025.

UBS forecasts suggest that the BOJ could hike the policy rate to 0.5% in the near future, followed by further hikes to reach a terminal rate of 1.0% by June 2025, contingent on positive wage growth and economic indicators.

Conclusion

The upcoming BOJ Outlook Report will be closely watched for any shifts in policy guidance, economic forecasts, and hints on the timeline for future rate hikes. Given the current economic and geopolitical landscape, the BOJ is likely to maintain its cautious stance, which could continue to influence the JPY's value against major currencies and the performance of Japanese equities.

Market participants should be prepared for potential volatility, particularly if the BOJ's tone deviates from expectations or if there are significant changes in economic forecasts. The report's release will provide crucial insights into the BOJ's strategy and its impact on the broader financial markets.