Upcoming RBA Announcement and Governor Michele Bullock's Speech: Key Insights and Implications for AUD/USD

As the Reserve Bank of Australia (RBA) prepares to announce its monetary policy decision, all eyes are on Governor Michele Bullock, who will address the press and provide crucial insights into the central bank's policy outlook. Here’s a detailed analysis of what to expect and how it might impact the Australian Dollar (AUD) against the US Dollar (USD).

Interest Rate Decision: No Change Expected

The RBA is widely anticipated to maintain the Official Cash Rate (OCR) at 4.35%, a decision that aligns with market expectations. This rate has been held steady for several consecutive meetings, reflecting the central bank's cautious approach to managing inflation and preserving the labor market[3][5].

Inflation and Economic Outlook

Governor Bullock has consistently emphasized the RBA's primary goal of returning inflation to the target range of 2-3%. Despite a decline in inflation since its peak in late 2022, underlying inflation remains above target. The Trimmed Mean Consumer Price Index (CPI) stood at 3.5% in the third quarter, still above the desired range. Bullock has highlighted that the process of bringing inflation back to target is slow and bumpy, with significant uncertainty surrounding the forecasts[2][5].

Labor Market and Economic Conditions

The Australian labor market remains strong, but there are signs of easing employment growth. The RBA is keen to preserve this labor market strength while navigating the challenges of high inflation. Recent data, including a decline in consumer spending and slow business investment growth, suggest that the economy is facing some headwinds. However, government spending has been a significant support, and the RBA is cautious not to underestimate its impact, especially in an election year[4][5].

Hawkish Stance and Market Implications

Governor Bullock's comments are likely to maintain a hawkish tone, emphasizing the need for interest rates to remain restrictive until there is clear evidence that inflation is moving sustainably back to the target range. This stance could provide near-term strength to the AUD, although any gains are expected to be short-lived given the broader risk-averse market environment[1][3].

Key Quotes and Policy Indicators

- Interest Rates: The RBA believes rates need to stay high for the time being to combat persistent inflationary pressures. There is no indication of a near-term rate cut, and the board is ready to raise rates if necessary[1][3].

- Inflation Risks: Bullock has pointed out that there are still risks on the upside for inflation, and the board needs to be convinced that core inflation is heading back into the target band before considering any policy changes[3][5].

- Labor Market: The RBA is focused on preserving the strong labor market, which is seen as a critical factor in the economic outlook. Employment growth is expected to ease gradually, but the RBA aims to avoid a rapid increase in the unemployment rate[5].

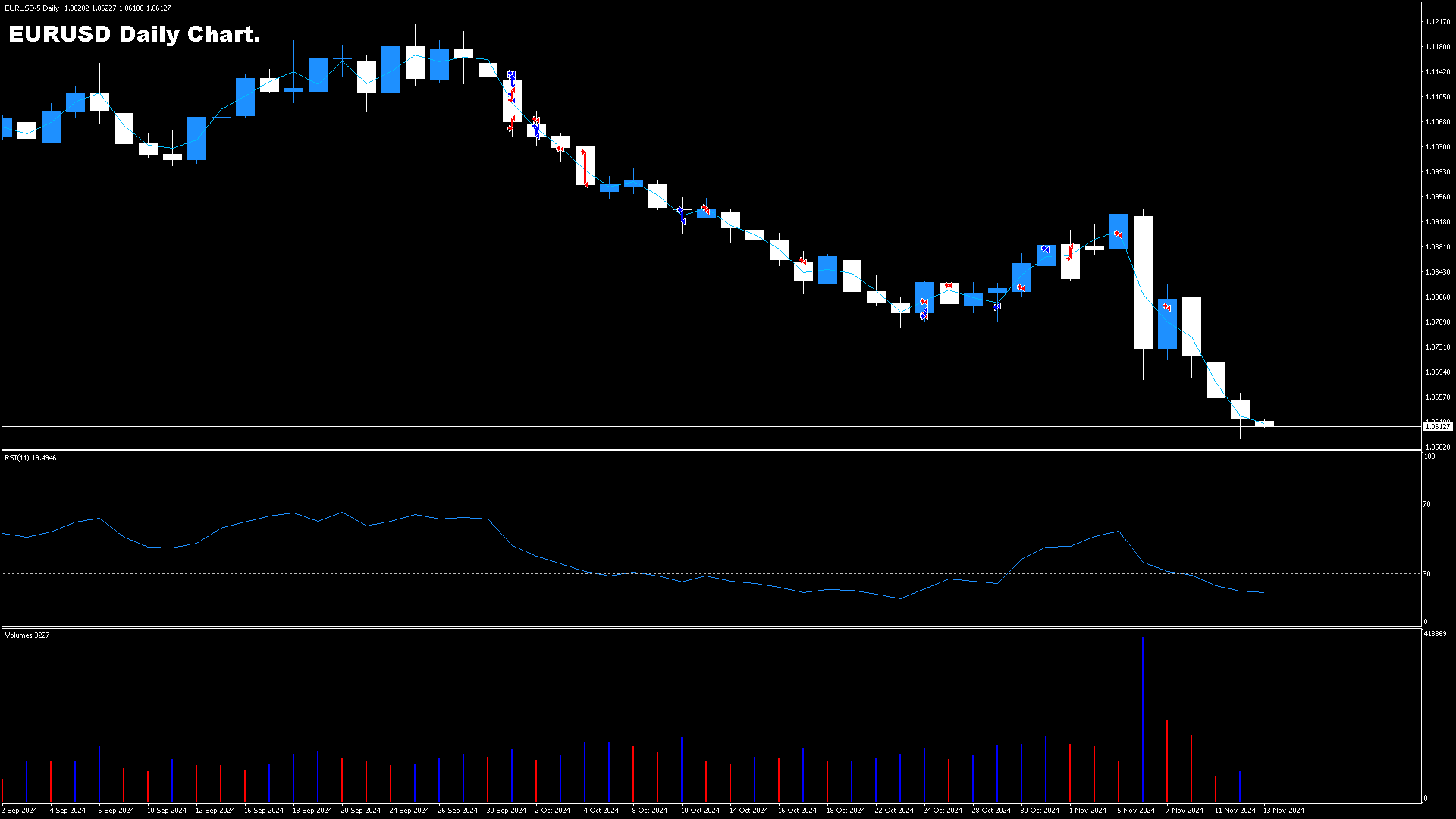

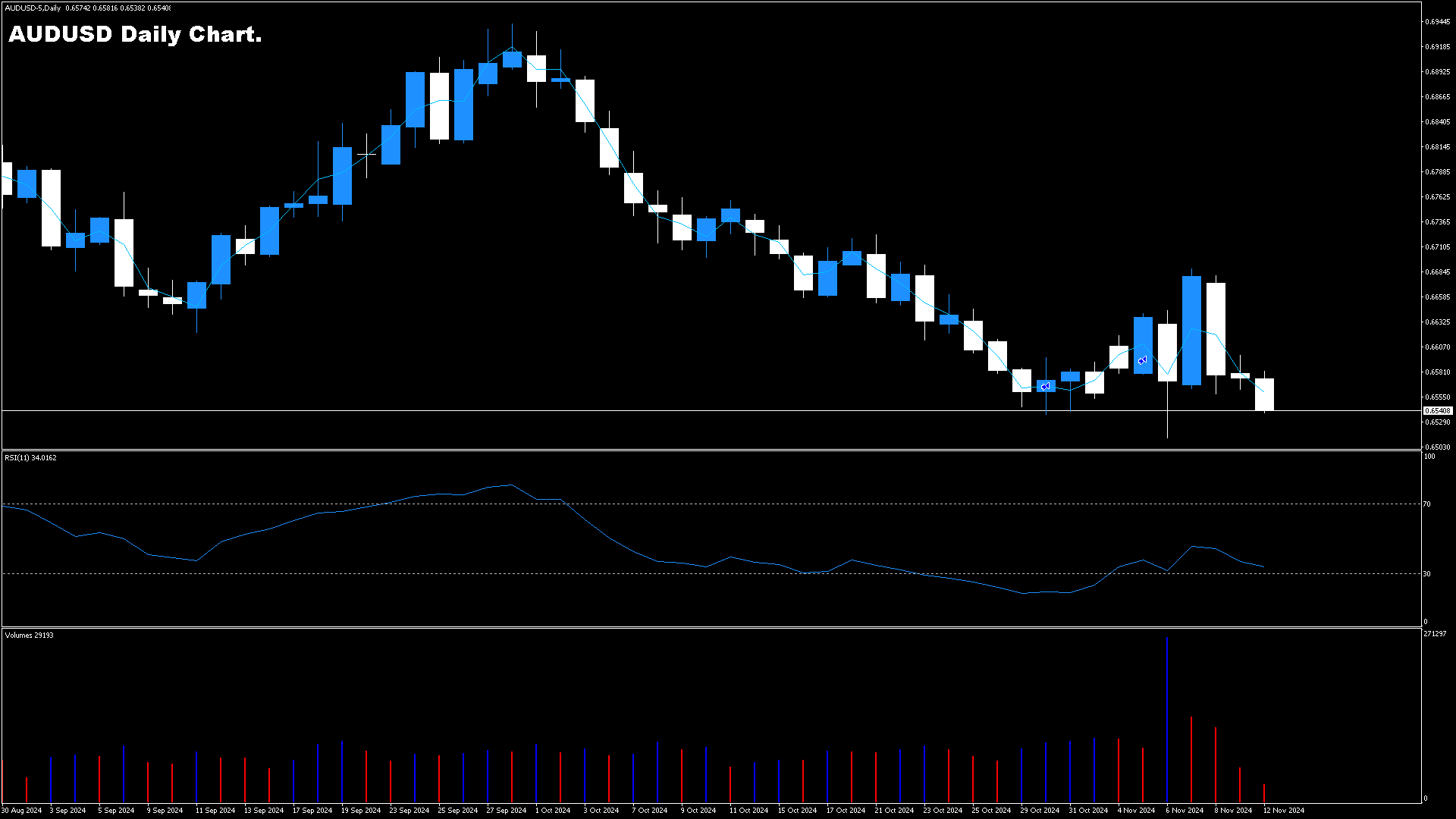

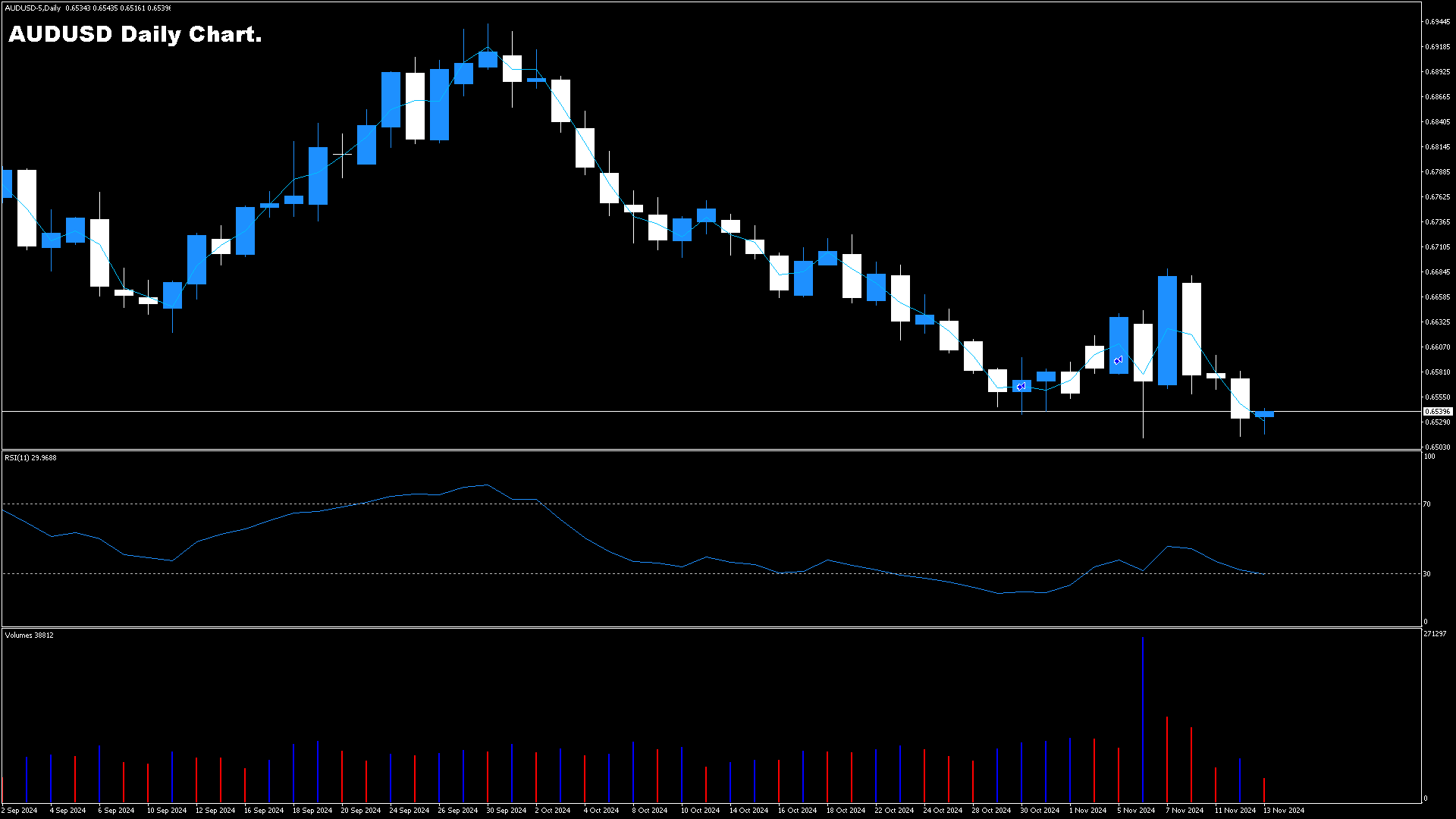

Impact on AUD/USD

The AUD/USD pair is likely to react based on the tone and content of Bullock's speech. Here are the potential scenarios:

- Hawkish Comments: If Bullock reiterates the need for restrictive interest rates and acknowledges upside risks to inflation, the AUD could experience a short-term boost, potentially driving the AUD/USD pair back toward the 0.6700 level[3].

- Dovish Surprise: Any unexpected dovish stance or discussion of potential rate cuts could lead to a sharp sell-off in the AUD, pushing the AUD/USD pair toward the 0.6500 level[3].

Conclusion

As Governor Michele Bullock addresses the press, her comments will be scrutinized for any hints on future policy directions. Given the RBA's commitment to controlling inflation and the current economic conditions, a hawkish hold is the most likely outcome. Traders and investors should be prepared for potential volatility in the AUD/USD pair, with the Australian Dollar's performance heavily influenced by the central bank's stance on interest rates and inflation management.